Last week I finished reading Severance, Ling Ma’s first novel from 2018 that I had bought my girlfriend as a birthday gift last month and which, having sped through it, she promptly returned to me to read in order that we could discuss it. It’s an excellent read, there’s no doubt about that, but it’s also an exceptionally difficult one to interpret. That Ma is clearly such an intelligent writer yet has written a story that in many ways makes little sense to me has made me question whether the book itself is flawed or if I am having trouble accepting its message. The below is not a review but an attempt to order my thoughts in the hope that I might figure out which it is. Spoilers for everything from this point on, although I’ll likely not provide enough details for those that haven’t read the book to follow, so worst of both worlds I guess.

The basics first. Our main character is Candace Chen, twenty-something daughter of recently deceased Chinese immigrant parents, who moves to New York after graduating and after a few years lives through the end of the world. This particular end of the world is a fungal pandemic that slowly reduces people to (harmless) zombies, living out the motions of their former routines with diminishing consciousness until they die of malnutrition or simply rot away. There are obviously some superficial elements of premonition for readers coming to the book post-Covid but to claim that the story is really about pandemics in any deep sense is to do it a disservice. Instead I’d suggest that the elements of the past 18 months of reality that we can recognise in Ma’s fiction are merely a byproduct of her lucid understanding of capitalism. After all, what is obvious is that the book is really about capitalism and the immigrant experience.

Perhaps there would be some readers who would not grasp that Ma is trying to convey a message about capitalism but there’s no prize awarded to those who do understand this link. Indeed the book is in no way subtle about this and neither are the publishers – you’d have had to open the book’s covers very quickly to have not seen the review quotes chosen to emphasise that it’s a ‘dystopian takedown of capitalism’ and an ‘anti-capitalist zombie novel’. Candace is such an engaging character to be inside the head of partly because she so keenly observes the true nature of the economic system she occupies and its through these observations that Ma builds a pervasive sense that capitalism and the apocalypse are really one and the same. Hard to argue with that, for sure.

There’s clearly however something deeper to what Severance has to say about capitalism than simply that it’s super not good. The novel is fascinatingly obsessed with the notions of routine and nostalgia and it’s these things that are supposed to link capitalism and Shen Fever, as the plague is called. It’s at this level that I fear the book’s message is either tragically confused or crushingly bleak.

The fevered act out the routines of their old life, whether that be domestic labour like setting the dinner table or wage labour like folding clothes in a shop.

“..the fevered were creatures of habit, mimicking old routines and gestures they must have inhabited for years, decades.”

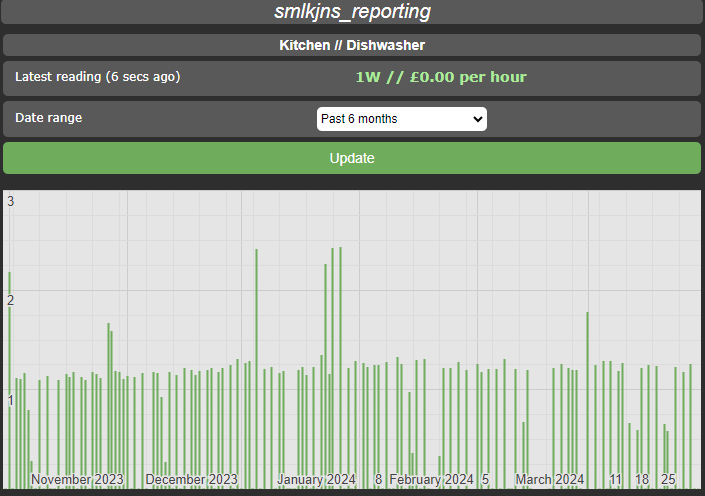

“They could operate the mouse of a dead PC, they could drive stick in a jacked sedan, they could run an empty dishwasher, they could water dead houseplants.”

These routines are to be read, presumably, as an extension of capitalism, as evidence of the extent to which capitalism’s compulsions have permeated the lowest levels of our psyche that even when reduced to barely alive zombies we continue to perform them. Or, alternatively, it is these very compulsions that reduce us to barely alive zombies. The routines repeated by the fevered are though at least partly informed by nostalgia, by what brings us comfort and familiarity, rather than simply that which we have done most, as Ma explicitly tells us:

“They were more nostalgic than we expected, their stuttering brains set to favor the heirloom china, set to arrange their aunts’ and grandmothers’ jars of pickles and preserves in endless patterns of peach, green bean, and cherry, to play records and CDs and cassette tapes they once must have enjoyed.”

So does Ma understand nostalgia and routine as the same things, at their root, or as different things? As the pandemic progresses Candace watches New York empty out and shut down as people leave or become fevered. Many leave the city to return to their family, back to their roots, the location of their nostalgia, but Candace has no roots to return to. Her parents have now passed and she has no other relatives in the US but the flashbacks to her childhood and her parents’ past prior to her birth establishes that this rootlessness has been part of her experience of the world all along. She tries to contact the few relatives she has details for back in China but with no luck. Her parents’ house has been sold and all their possessions are in storage far from her. Apart from perhaps Jonathan (who we’ll come onto later) she has no sense of home and is defined by the fact that she is deprived of nostalgia.

So as more and more people succumb to the fever it is implied that Candace’s continued health is either a result of or symbolises her lack of nostalgia. The book shows very little concern for establishing rules for the fever, who catches it or why or how it progresses, which I appreciate as an encouragement to not interpret the story too literally. There’s a hint that those in a similar position to Candace, immigrants deprived of a sense of roots, either likewise avoid becoming fevered or avoid it for longer than others. Eddie, the Hispanic taxi driver that picks up Candace when the city is almost empty, jokes that all the white people have finally left and notes that New York belongs to the immigrants now as it has in fact always done. Eddie is then later the last person Candace sees before leaving the city, fevered (probably, there’s some ambiguity I didn’t understand the purpose of) but potentially the last person other than Candace to have fallen victim to it.

Whilst Candace may be defined on the one hand by her lack of nostalgia then, on the other she is defined by her obsession with routine. As everyone else leaves New York in pursuit of nostalgia, Candace accepts a contract to continue to staff the office alongside a small group of others. As management retreat to remote working they leave behind cameras and card scanners to surveil those in the office but Candace appears to be the last one to imagine that there might actually be no one left on the other side of that technology watching her. As the in-office staff diminish, she diligently performs the routines of her work until she encounters two of her remaining coworkers drinking in an off limits area who not only break the news to Candace that they’re the only ones left but are horrified by the idea that she will continue to stay in the city, continue to keep coming to work.

The book seems unsure whether Candace take and remains committed to this contract to staff the office because it gives her purpose or because of the scale of the financial award that she fails to anticipate will be worthless by the time she receives it. A big point is made that the pay, deposited only upon completion of the contract, would be life changing:

“It was a delirious offer … it meant I could take cabs all the time, without cramming into dirty train cars. It meant an air conditioner, a window unit in every room. It meant a larger apartment. It meant that I could afford more for the baby. It meant that I could eventually take some time off to do other things. Take an extended maternity leave. Read more fiction. Take up photography again.”

Yet toward the beginning of the book, when we follow her first few weeks in New York in which she pursues a routine of walking all day and makes no effort to get a job, we’re told that she’s freed of financial concerns in at least the medium term:

“I live off my parents, I said … I didn’t elaborate that they were both deceased … the family coffers or whatever would last me just long enough – maybe, say, for the next ten, fifteen years – for me to be comfortable with not working…”

Perhaps Candace is being insincere to herself when she thinks of the contract’s pay as reason for her to do anything then. This at least aligns with the fact that when her the contract’s payment finally does arrive (presumably automated), it is a surprise to Candace who has lost track of the date in the face of the end of the world. If she was not really concerned with the money though we are presumably left to believe that she accepted the contract as an excuse to continue to perform the routines of capitalism. Certainly in keeping with her dedication to routines but confusingly at odds with her keen awareness of capitalism’s unpleasantness.

So she continues uselessly going into the office everyday to check for emails which never arrive as the world collapses around her. When it finally becomes clear to her that there is no work to be done, she takes up photography assignments from visitors to her blog as a deliberate attempt to find a substitute for her work, still doing so from the office and eventually moving into the office as commuting becomes impossible.

Why is Candace so desperate to maintain routine when it is clear that these routines bring her no joy? Both she and the book repeat on several occasions an understanding of all the wonderful things one could do with their leisure time if they did not have to follow capitalism’s routines. For instance when the pandemic is in its early stages and a severe storm hits the city, offering the possibility that there could be a day’s reprieve:

“I was like everyone else. We all hoped the storm would knock things over, fuck things up enough but not too much. We hoped the damage was bad enough to cancel work the next morning but not so bad that we couldn’t go to brunch instead.”

“A day off meant we could do things we’d always meant to do. Like go to the Botanical Garden, the Frick Collection, or something. Read some fiction. Leisure, the problem with the modern condition was the dearth of leisure. And finally, it took a force of nature to interrupt our routines.”

Yet when the end of the world comes, a force of nature so strong that it interrupts everyone else’s routines, Candace is the only one standing still acting out the routines she claims to want release from. So whilst she is deprived of nostalgia, which renders her immune to the fever, she is obsessed with routine. And here is the core of my confusion: the fevered are creatures emptied of everything but routine – so why is it nostalgia, rather than routine, that dooms people to become fevered? Candace is consumed by routines she hates and yet refuses to jettison but it is not her who succumbs to the plague that would make her act out these routines for ever more, it is those who through extra-capitalist nostalgia are driven to abandon these routines.

I suggest here that nostalgia as presented by Ma is extra-capitalist, although this a point on which the book is again troublesome to interpret. The book jumps around several points in Candace’s timeline, largely showing us her experience of the run up to the collapse of society in New York concurrently with her experience trekking across the country with a small group of survivors toward ‘the facility’ where the group’s leader Bob intends for them to settle. There’s much in this post-NY element of the timeline that seemed to setup themes that were then forgotten but two key events during Candace’s time with the survivors seem designed to further establish the link between nostalgia and the fever. In the first third of the book the survivors spend a night camping close to the childhood home of one of the group, Ashley. Knowing that Bob would not allow it, some of the group sneak out in the middle of the night to visit the house and upon entering her old bedroom, filled with her old belongings, she becomes almost immediately fevered. She goes through the motions of trying on dress after dress, posing in front of the mirror, unresponsive to the others as they scream and shout at her. Ma perhaps hints that she wants us to read this fevered behaviour as a performance of consumerism or the sexual dynamics of capitalist society, describing how Candace watched Ashley “rehearse her sexuality, informed by the most obvious movies and women’s magazines”. Looking past this line though, fundamentally Ashley becomes fevered when she is able to engage in her nostalgia rooted in presumably happy, safe memories of being a teenager in her family home.

The second key event in the post-NY section of the story takes place at the very end of the book (and so major spoilers here). With the group of survivors having arrived at ‘the facility’ that turns out to be a shopping mall which Bob spent much of his childhood wandering around and, somewhat unbelievably, owned half of prior to the apocalypse, Bob effectively imprisons Candace. Considering her joining the group on the unsanctioned and ill-fated visit to Ashley’s family’s house to be a betrayal but fixated on the significance of Candace’s now revealed pregnancy, Bob has her locked in one of the mall’s stores behind its shutters. Recognising that once her baby is born her safety is likely to be of little concern to Bob, she plots to steal a set of car keys in the night and make an escape. At the crucial moment however, as she has managed to sneak her way across the mall in the middle of the night, she is confronted by a now suddenly fevered Bob.

In one of the last conversations with Bob before this happens, we learn the extent to which the mall is a source of nostalgia for him:

“This place … holds a great deal of sentimental value for me. I used to go to this mall when I was younger … My parents would drop me off here, and I’d spend hours just walking around. I’ve probably spent more time here as a kid than anywhere else.”

“I’d just walk around. When I was hungry, I’d eat free samples in the food court. When I was bored of walking, I’d play games in the arcade. The employees knew me. They’d give me extra tokens.”

So again, as with Ashley, the subject of Bob’s nostalgia is on the very surface perhaps a phenomenon of consumerism in that its location is a shopping mall – assuming this wasn’t entirely just a nod to the zombie genre’s tropes. Beyond this though, just as Ashley’s nostalgia wasn’t really about the dresses as commodities as much as it was about the comfort and safety of posing in them in her childhood bedroom, Bob’s nostalgia isn’t really about the mall as a site of consumerism but instead his fond memories of being able to entertain himself there as a child in spite of his limited capacity to engage in the consumerism around him. The one hint that Bob might be falling to the fever before Candace’s escape is when he claims to not know what Candace means when she asks him why he walks around the mall every night – another suggestion that it is this walking around he is nostalgic about rather than anything to do with the consumer transactions the mall exists to facilitate.

For both Ashley and Candace then, the nostalgia which makes them fall victim to the fever is, rather than a clear extension of capitalism, in fact extra-capitalist at least to the extent that fond memories of their childhoods are. The fleeing of Candace’s fellow New Yorkers back to the perceived safety of family homes, a nostalgia Candace lacks due to her rootlessness, aligns with this so closely that it cannot be accidental.

In the last chapter, with Candace having made her escape from the facility and headed into Chicago, she contemplates how she can begin to cultivate a sense of second hand nostalgia built upon the stories that Jonathan, her boyfriend in New York prior to the pandemic, told her of his own years spent there. As she drives further into the city she realises that she in fact very briefly visited Chicago herself once as a child, tagging along with her mother on one of her father’s business trips that she had until this point forgotten. She remembers a discussion with her mother on the trip about what it would be like if they lived in Chicago and, it is implied, she begins to build her own nostalgia for the first time around the scaffolding of Jonathan’s. This nostalgia is in some ways a future-facing one and she considers how her unborn child, to which Jonathan is the father, might in spite of the end of the world and her mother’s rootlessness be able to feel tethered to the city, to feel that it is their home.

It’s pertinent here to point out that Jonathan had huge potential to play a pivotal clarifying role for the book’s themes and message but is denied the chance to ever complete this role. Unlike Candace, who – full of contradictions – remains committed to her job despite her distaste of capitalism, her recognition of the pointlessness of that job and indeed not particularly wanting to have acquired the job in the first place, Jonathan refuses to partake in regular employment and instead ekes out a frugal living from odd part-time jobs that he regularly quits. Candace shares his cynical assessments of New York – of its gentrification, its consumerism, etc – but considers him idealistic. For her, the sacrifices he has to make to opt out of capitalism in the limited ways in which he does are not worth the price and this difference between them is why they eventually part company:

“You think this is freedom but I still see the bare, painstakingly cheap way you live, the scrimping and saving, and that is not freedom either. You move in circumscribed circles. You move peripherally, on the margins of everything..”

Though she doesn’t admit this to him, she concludes that:

“In this world, money is freedom. Opting out is not a real choice.”

So whilst Jonathan opts out of the capitalist routines of work from the beginning of the story, making severe sacrifices to do so, Candace remains seemingly the last person in the world opting in to capitalist routines of work even when there is nothing left to gain from them. Surely this must have been intended as a dynamic to help clarify where capitalism sat in the relationship between routine, nostalgia and the fever. Yet we don’t learn Jonathan’s fate. We don’t know if he becomes fevered, or more importantly if he does, we don’t know under what conditions he becomes fevered or how these connect to his own complex nostalgias. If the fates of the other characters are any indication he will presumably have become fevered if he found himself able to indulge in any extra-capitalist nostalgia. If Jonathan was intended to push us to read the book differently, I’d argue some pages must be missing from my copy.

In the final pages then, as Candace is reaching the centre of Chicago, what might in another book have been a hopeful ending can only be read as cruel. Whether deliberately or through its confusion the only version of the book’s message that makes sense is that the fever, an extension of or stand in for capitalism, which turns people into mindless zombies destined to repeat the motions of capitalist routine until they rot away, will infect those who are motivated to break these routines by extra-capitalist nostalgias. Meanwhile those who decline to stop performing capitalism’s routines, even when all compulsion is removed, are seemingly rewarded by being spared from the fever. It follows then that as Candace begins to build her own nostalgia for the first time with the help of her anti-capitalist former-companion’s own nostalgia she is now destined to become fevered herself.

Is Severance really a ‘takedown of capitalism’ then, or a warning that trying to escape capitalism will only make it worse? Did Ma intend the book to tell us that capitalism will reduce us to zombies and it got mixed up somewhere along the way, or did she intend it to tell us that even trying to escape capitalism will reduce us to zombies and that’s just not what I wanted to hear?

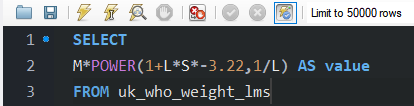

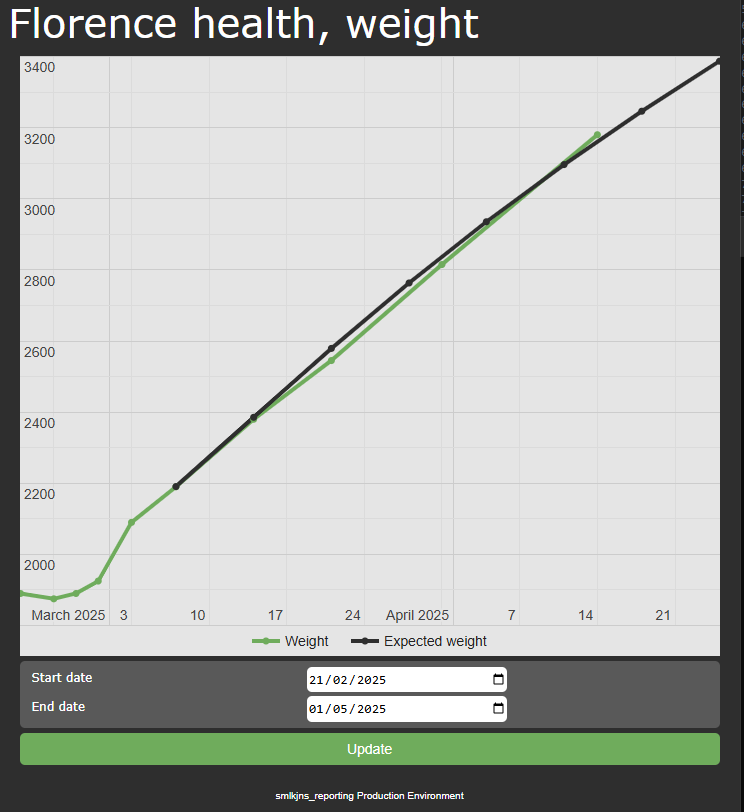

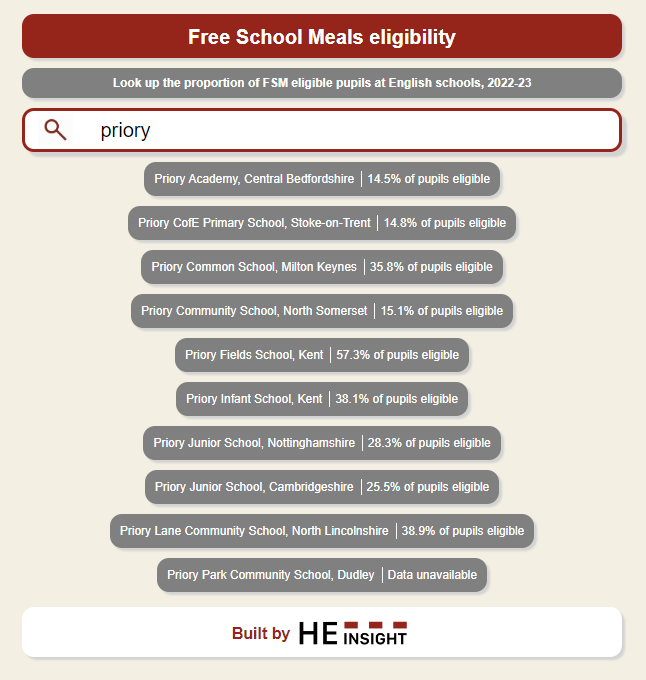

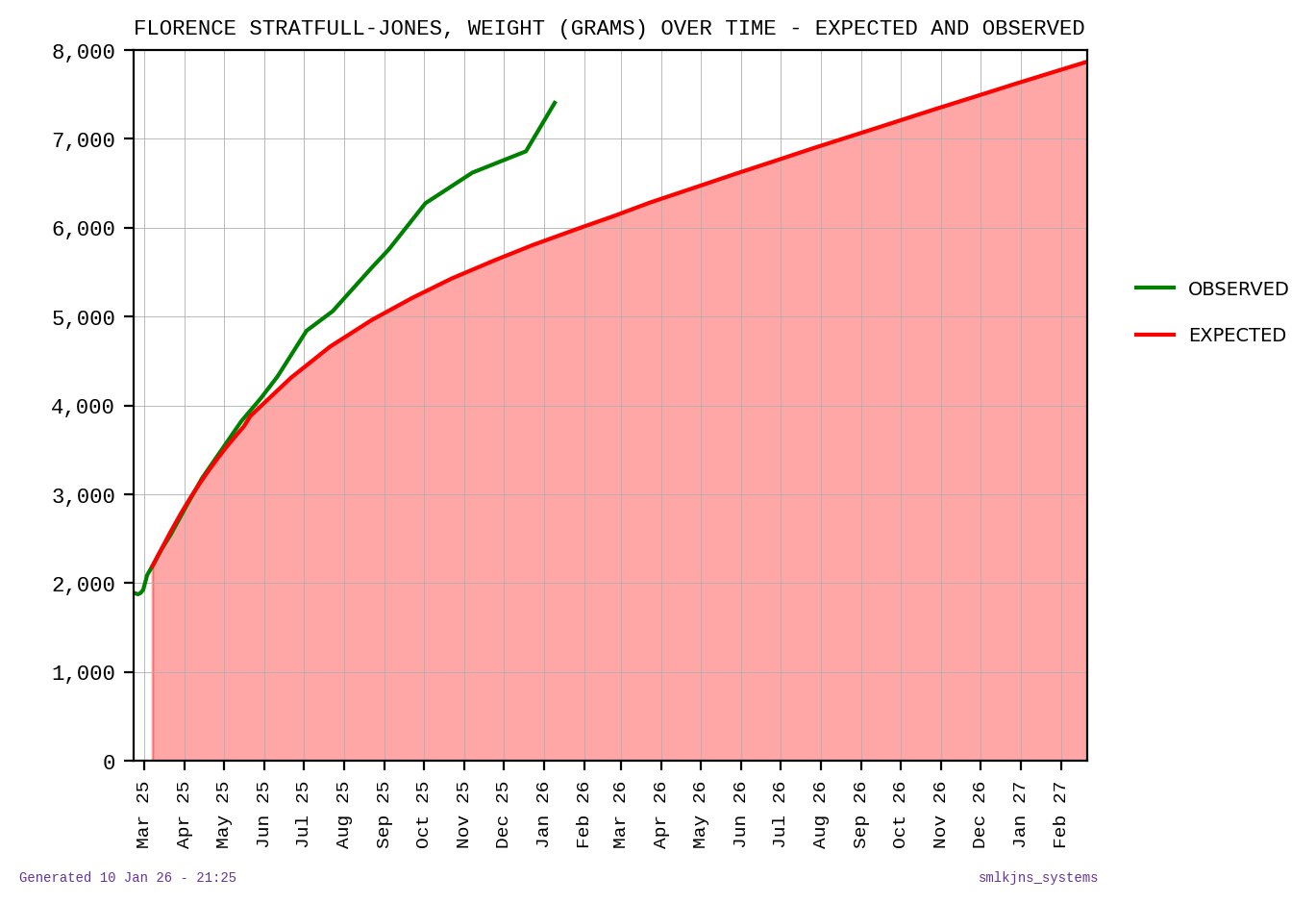

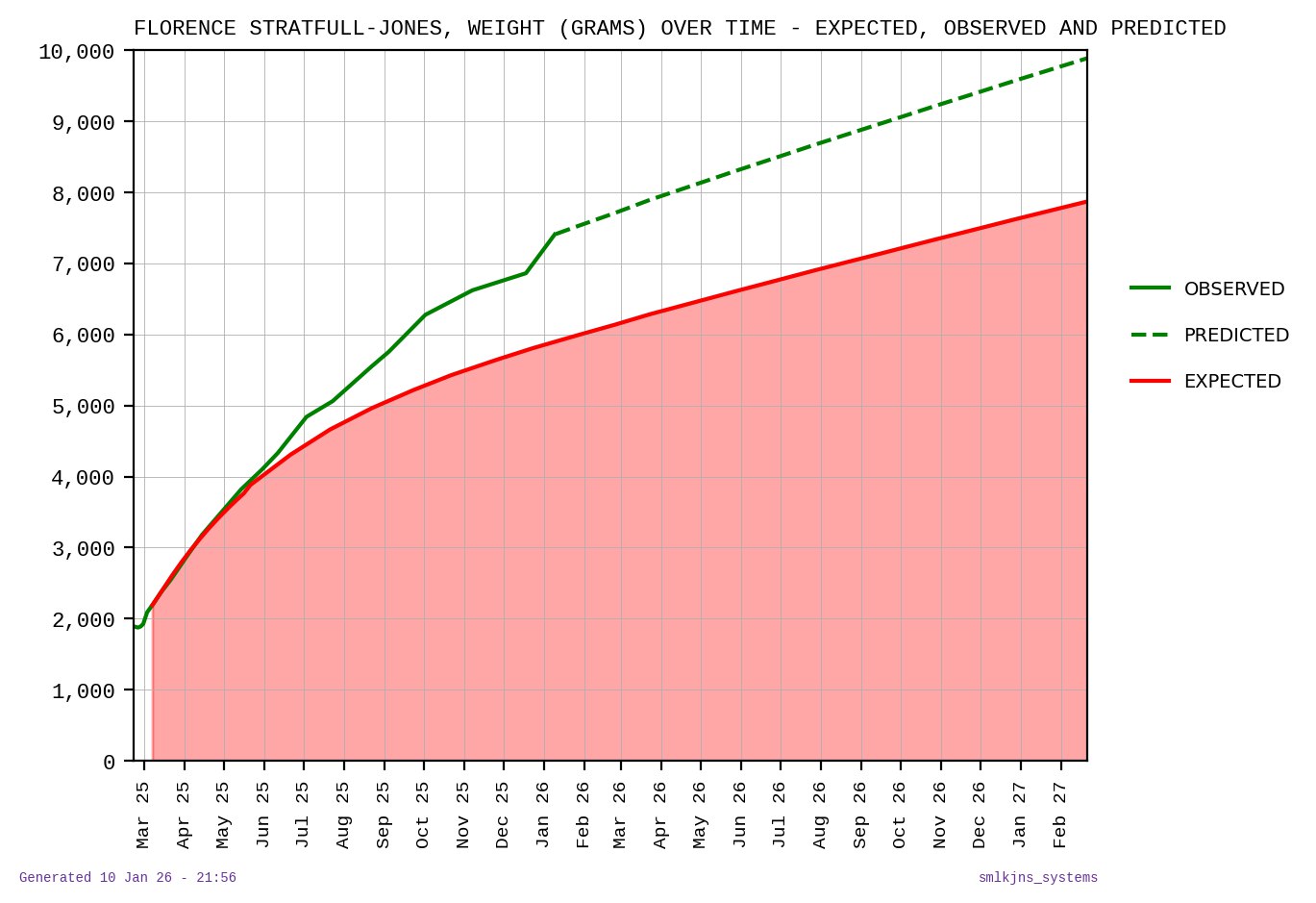

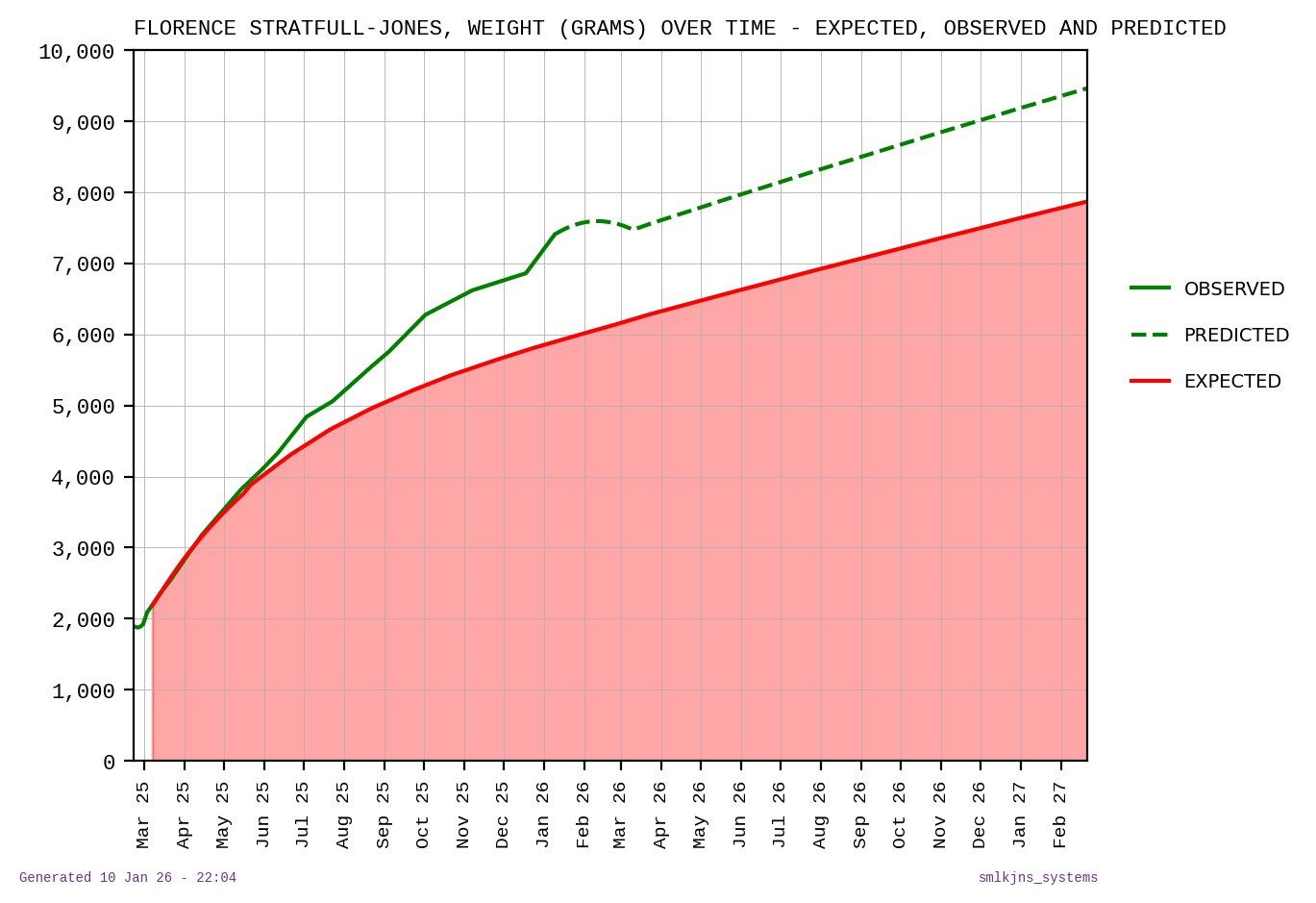

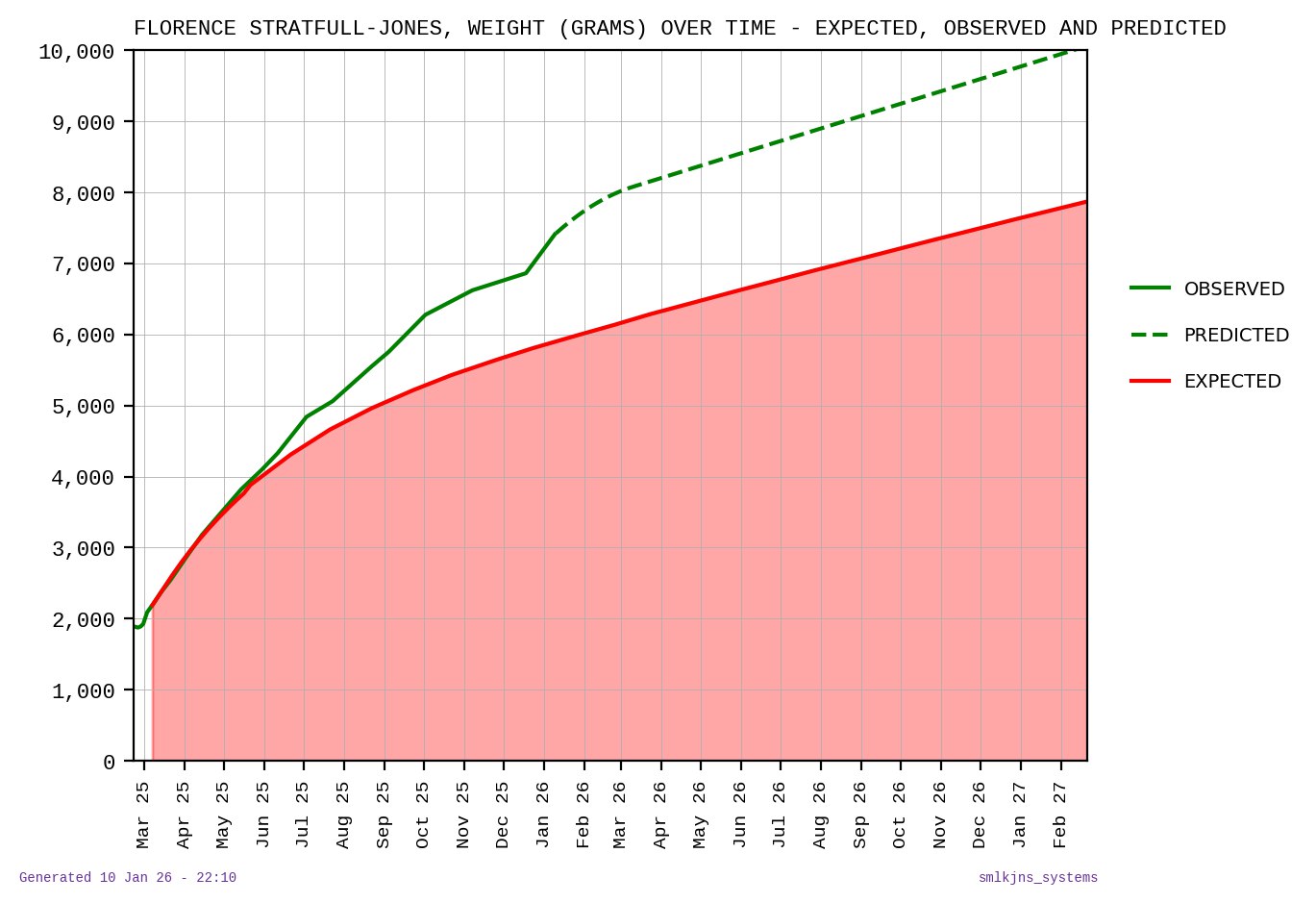

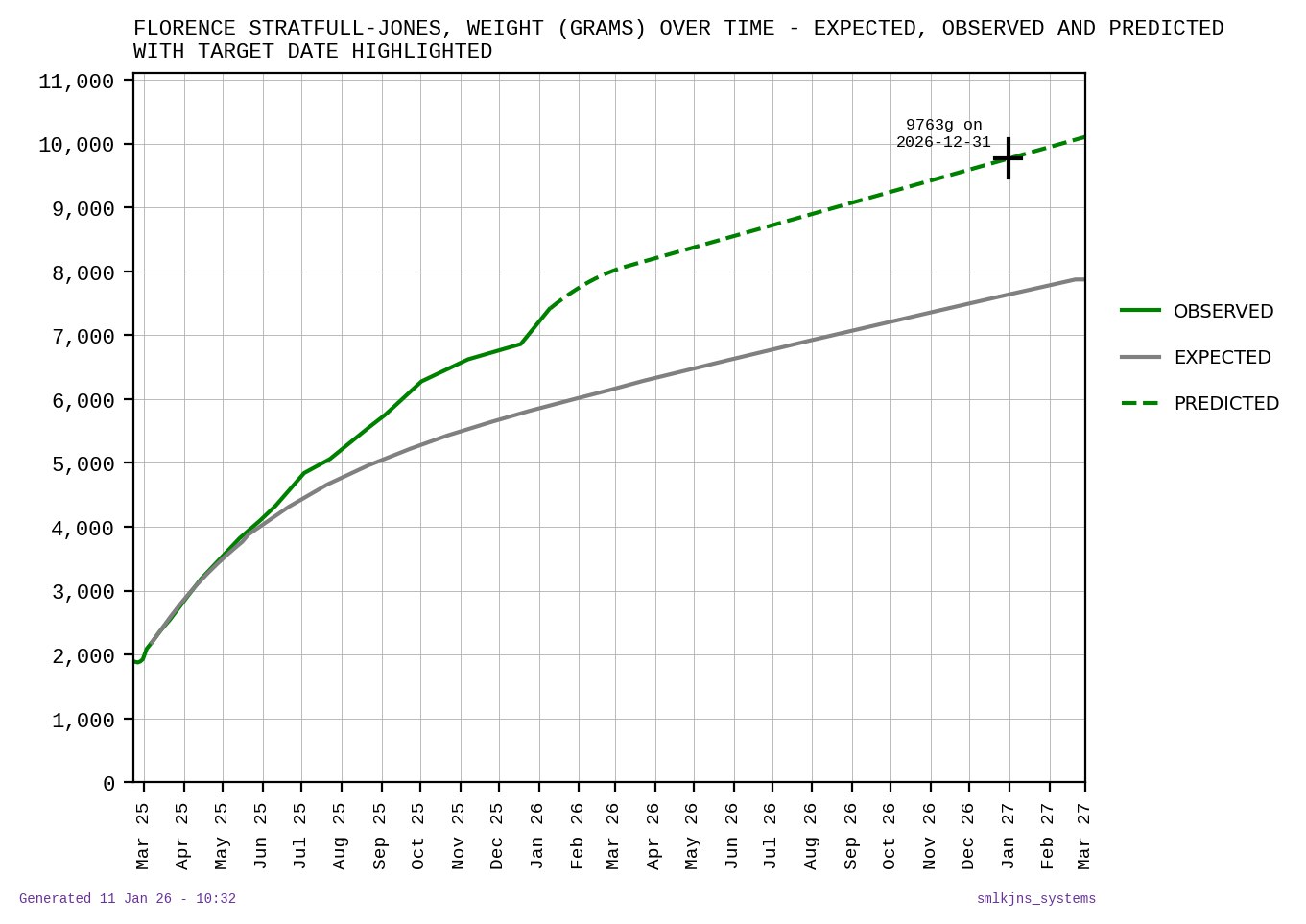

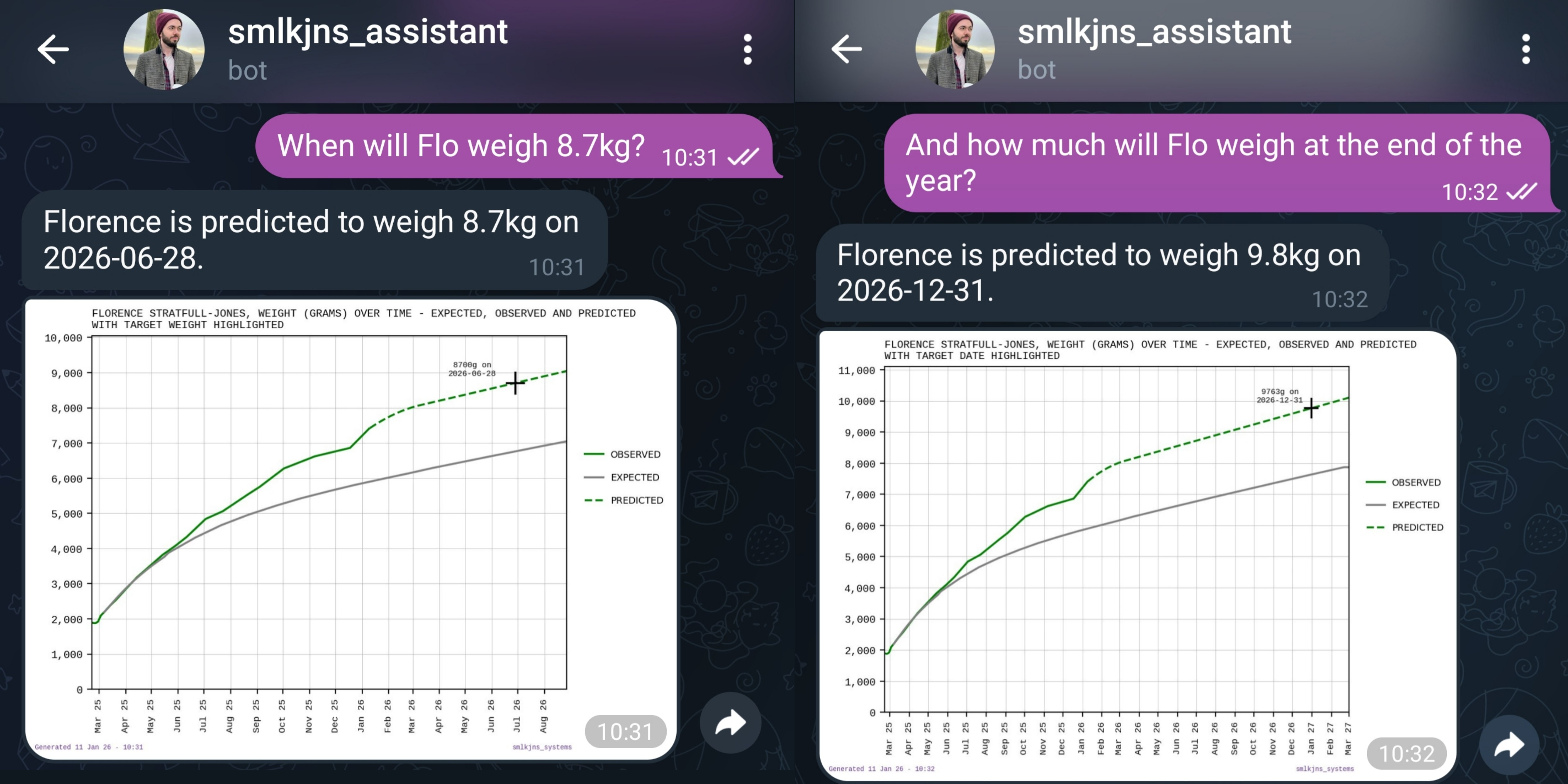

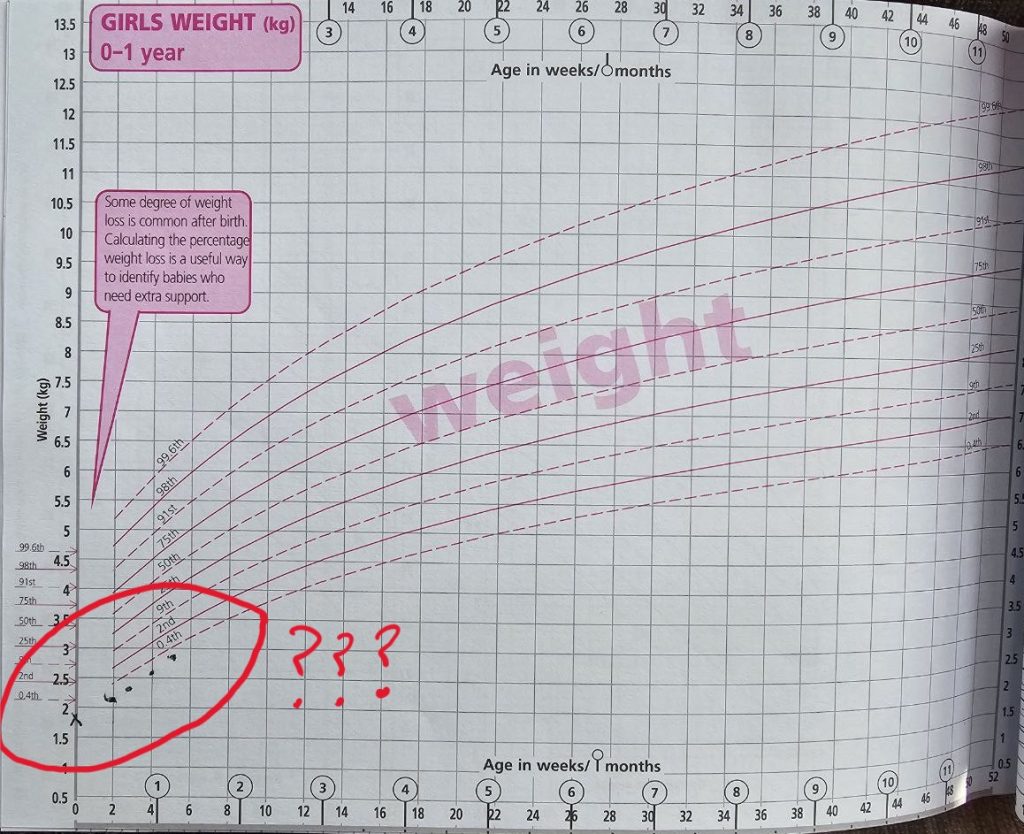

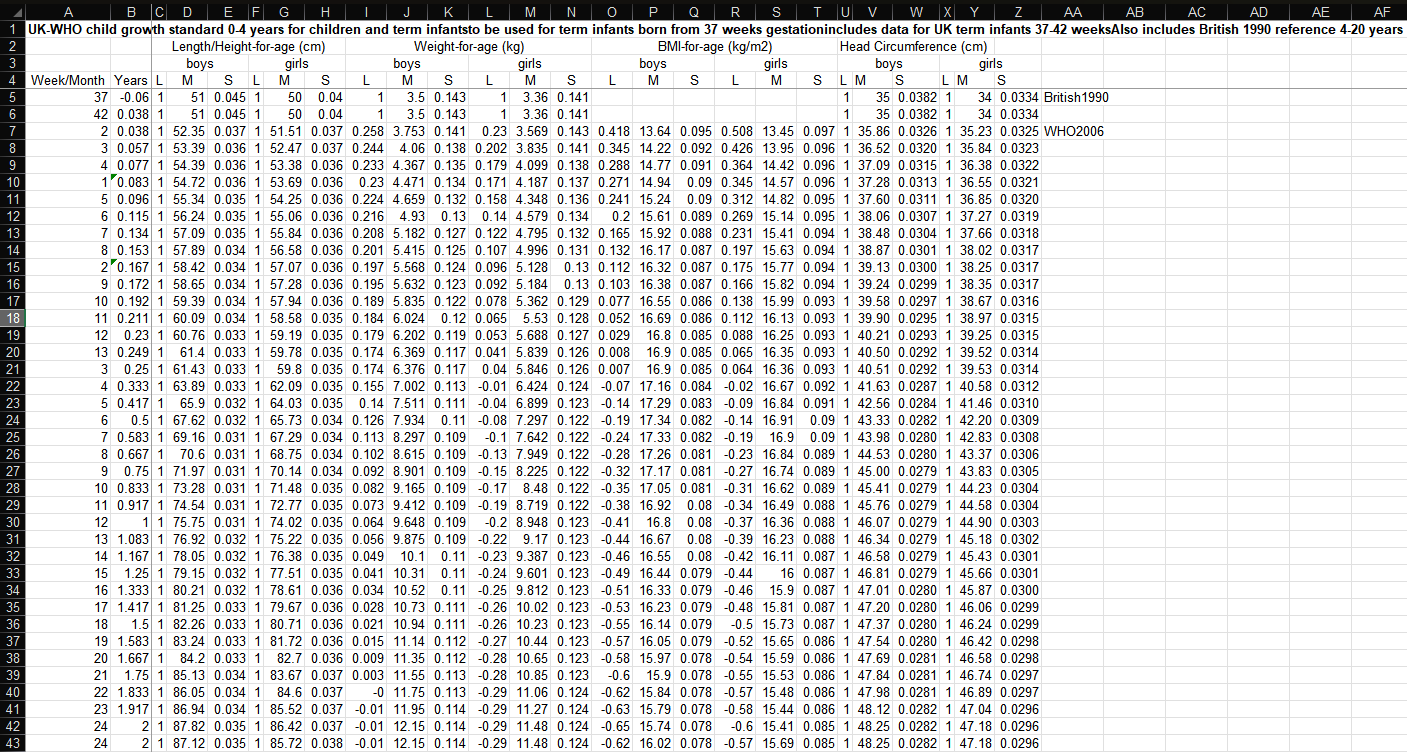

There are those L, M, S values that I needed to construct the smoothed curve. Setting aside the slightly confusing mixed economy of weeks/months in the first column, you can see that the pre-birth rows (37 and 42 weeks gestation, the bounds of a baby considered born at term) belong to a different dataset than the post-birth rows. That latter dataset only starts at 2 weeks, so that’s actually the point I used to baseline Florence rather than her birth weight. I’ve no idea if this is the correct approach but I also happened to have a weight reading for Florence at exactly 2 weeks, so it was at least the convenient approach.

There are those L, M, S values that I needed to construct the smoothed curve. Setting aside the slightly confusing mixed economy of weeks/months in the first column, you can see that the pre-birth rows (37 and 42 weeks gestation, the bounds of a baby considered born at term) belong to a different dataset than the post-birth rows. That latter dataset only starts at 2 weeks, so that’s actually the point I used to baseline Florence rather than her birth weight. I’ve no idea if this is the correct approach but I also happened to have a weight reading for Florence at exactly 2 weeks, so it was at least the convenient approach.