My daughter Florence was born around 8 weeks ago now, in late February. She was 1.89kg (4lb 2oz) at birth, which if it isn’t obvious is spectacularly small.

We knew that she was on the smaller side from early on in the pregnancy, then that she was very small, then from around Christmas – courtesy of an unexpected scan on Christmas Eve in fact – it started to become a real concern how small she was. At the start of January we had possibly England’s least compassionate fetal growth consultant grumble out a horrifying list of possible causes and outcomes for her persisting failure to grow sufficiently before getting impatient at us for not leaving his office fast enough. The rest of January was, simply, awful, as we went through a series of ordeals to eliminate some of those possible causes – the scariest of which we were thankfully able to. We finished January with the advice that she was ‘likely just small’, as opposed to being small for a reason, with little sense of how reassured to be by that assessment.

We continued going for fortnightly scans into February, without ever managing to figure out at what point the outcome of a scan might be something other than being booked in for the next scan. As the month went on a few other complications appeared and then gradually became more serious, until eventually we turned up to a scan at 37 weeks where we hoped to pin someone down on a timeline and likely options for delivery. Instead, we were told that Florence had stopped growing altogether and now needed to come out within the next 48 hours. Much of our January ordeals had been navigated with the help of much more caring and kind staff, though through poor luck this news now was delivered again by that original consultant who insisted that he’d told us all along to expect this (he hadn’t).

We thought turning up for what was supposed to be a 30 minute appointment that turned out to be a 48 hour countdown was the last big surprise Florence had for us, though she wasn’t quite done. We had contended with several overnight hospital stays before in the pregnancy, so had wisely packed some supplies in the boot of the car, though given we had started to assume she would be born closer to 40 weeks we unwisely had not brought our full hospital bags with us. Soph was admitted in the early evening and it was the middle of the night before she was found a bed to sleep in, then by the next morning we were told to plan for a c-section potentially that evening but more likely the next day. At that point I set off back home on a supply run to pick up our things, making it halfway down the M5 before getting a call to say that Florence was now not doing well at all and needed to come out very soon indeed. Thanks to a slightly spicy loop around Clevedon junction roundabout and an even spicier race back northwards I managed to make it back it time to get into some scrubs, have my attempt to read a guided meditation to Soph foiled by a fire alarm, then see Florence be brought into the world.

All things considered, Florence arrived in remarkably good health aside from her ultra low birth weight due to intrauterine growth restriction. She did however have to spend her first 5 days in an incubator and it was 8 days in total before we could bring her home – which had she been born 6 weeks later would have entitled me to additional time off work (I’m not bitter, you’re bitter). During our time in hospital the key metric for us was her temperature, taken before every feed, indicating whether she was still managing to maintain her temperature after each time the incubator was turned down a notch, then when she was first taken out of the incubator, then when we gradually reduced the number of layers she was wrapped in. She thankfully lost very little weight in the days after her birth, so it was her temperature readings that directly plotted a path to us being able to take her home.

Once we did finally all arrive home, it became Florence’s weight that was the key measure of her health. This is a very normal state of affairs for any newborn, though given we were being regularly visited by the NICU community outreach team on top of the standard mix of midwives and health visitors, Florence was weighed much more frequently than she might otherwise have been.

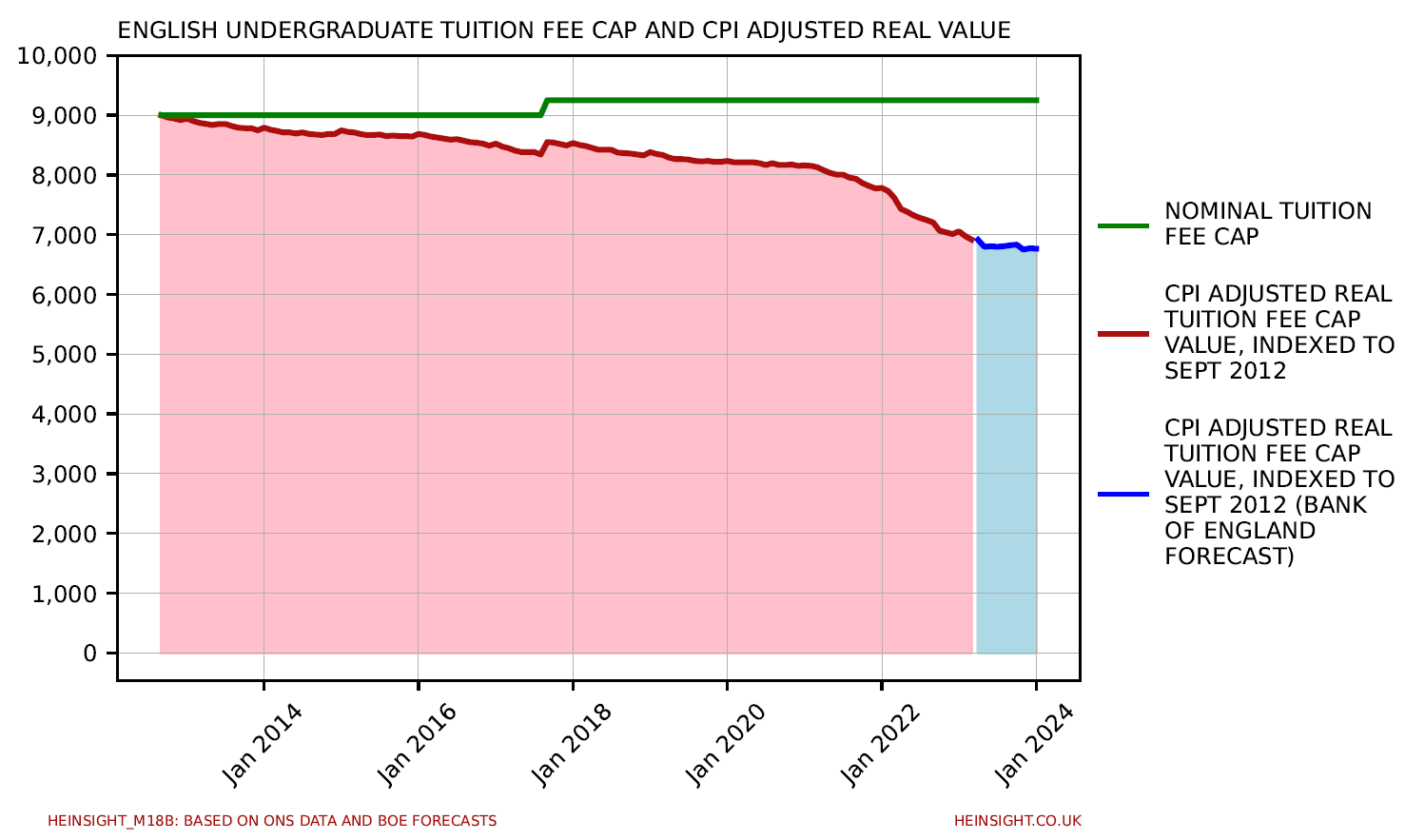

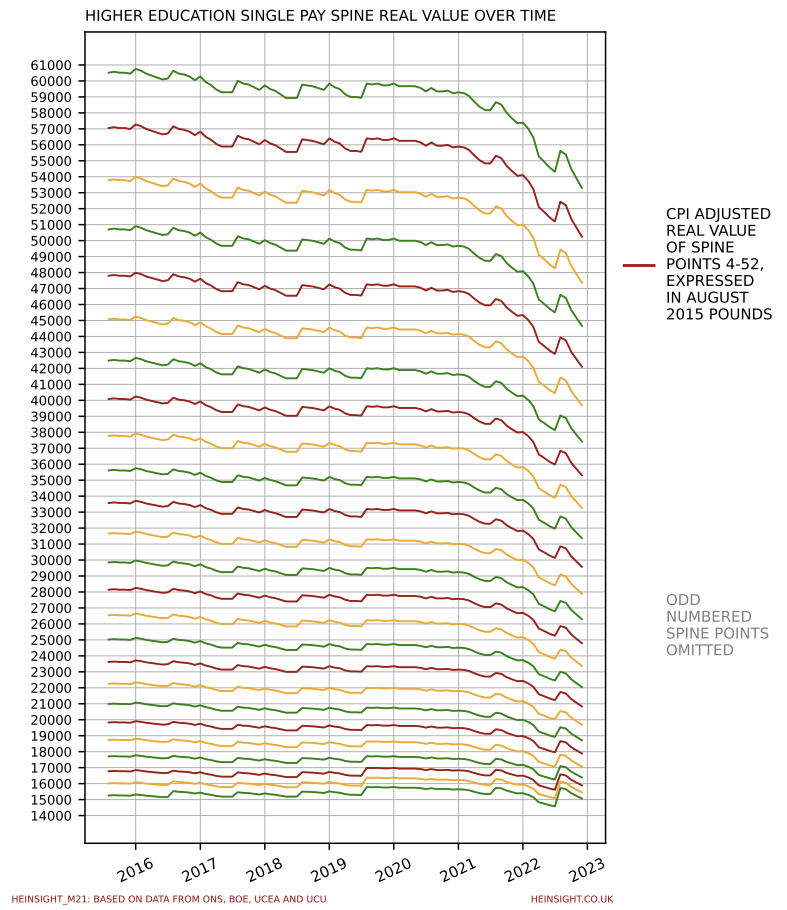

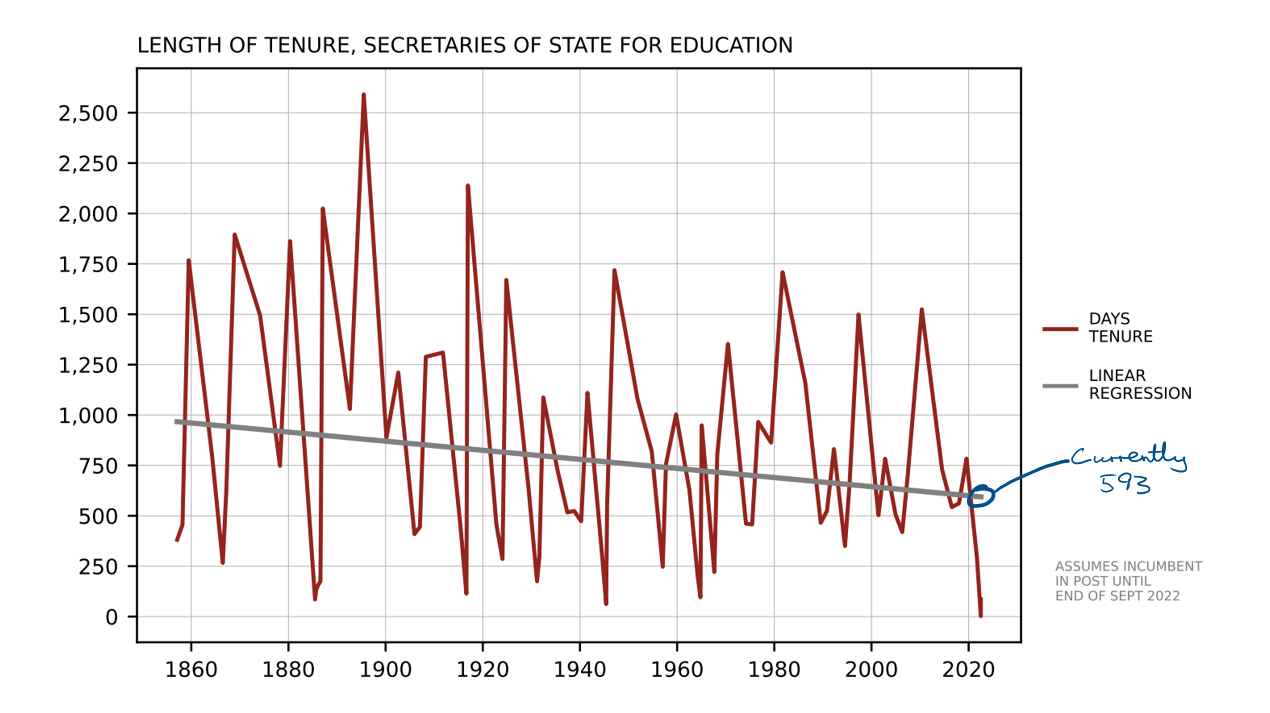

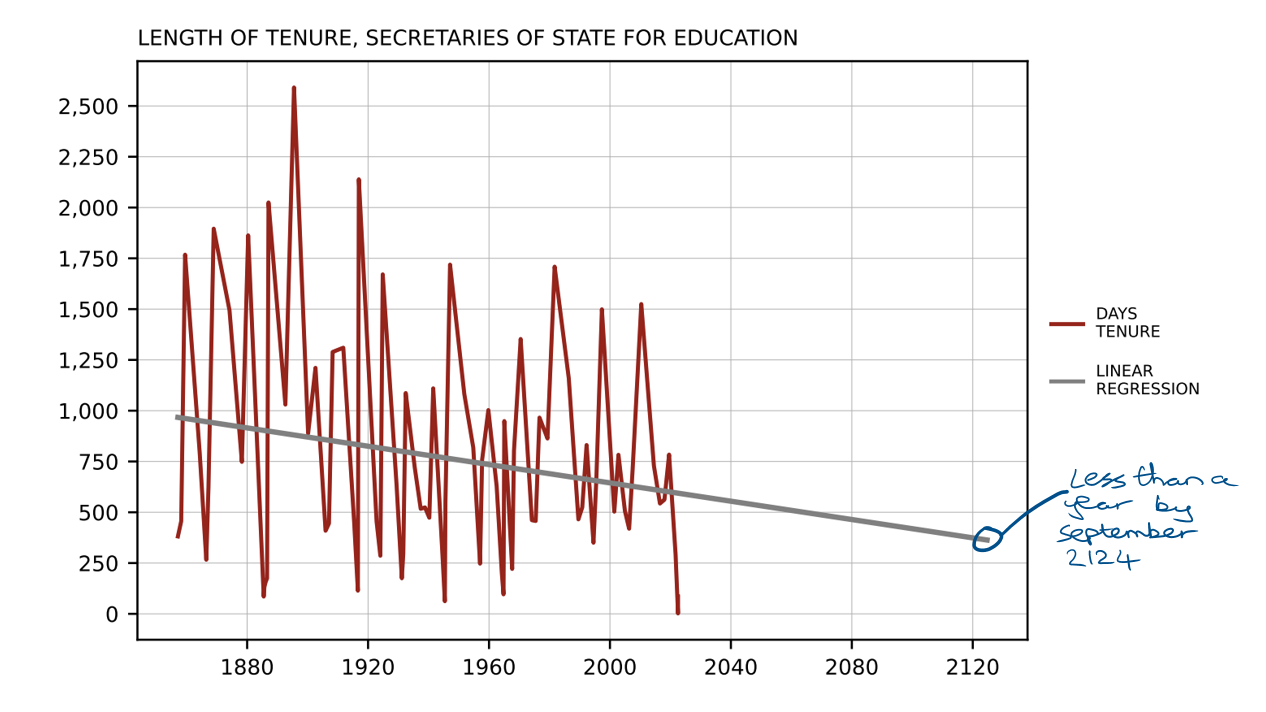

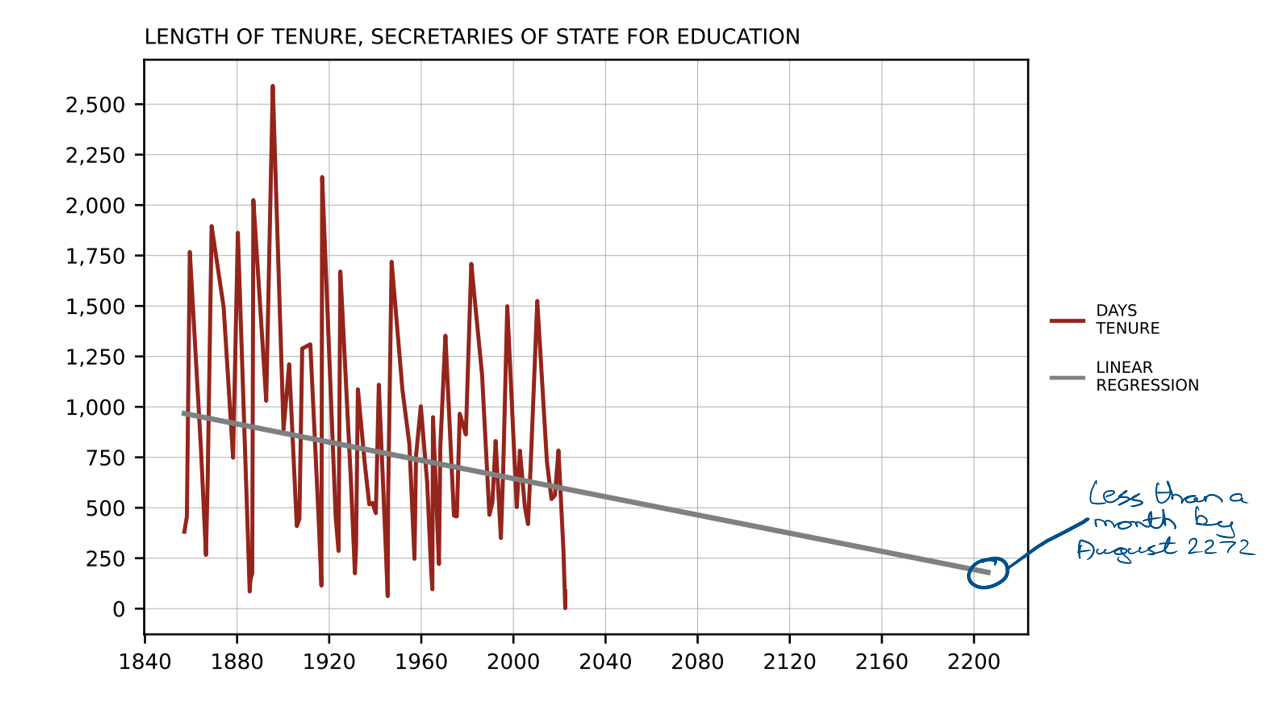

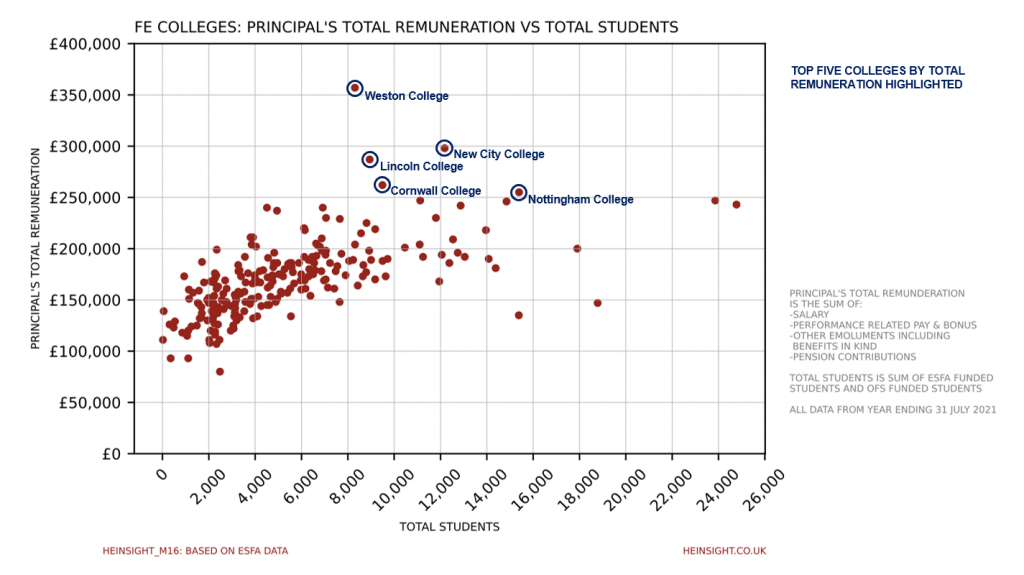

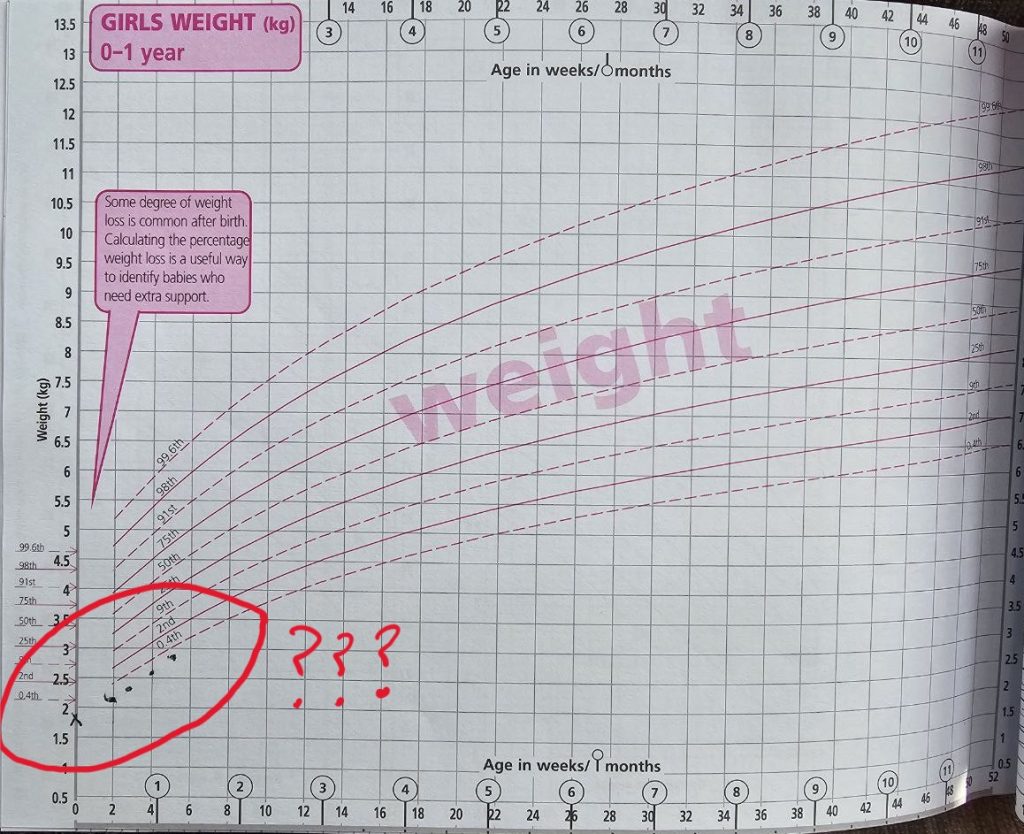

Anyone who’s had a baby in the UK will be familiar with the growth charts that feature in the ‘red book’. These ‘UK-WHO’ charts show expected head circumference, length and weight trends by sex for different centiles. The max centile plotted is the 99.6th and the min is 0.4th. No one had ever actually told us what centile Florence’s birth weight put her at but it was visually clear from the frankly ridiculous efforts to mark the chart by hand with her weigh-ins that she was far below even the 0.4th.

Now clearly Florence’s weight is going up rather than down here, so that’s a positive and I should emphasise I am very grateful that we didn’t have to suffer the anxiety of our baby struggling to put on weight that I know other parents may do. Given all the stress her lack of weight gain had caused us during pregnancy though, let alone the fact that everyone who met her was aghast at how small she was, those little pen marks scribbled in roughly the right place on the paper chart weren’t quite enough to satisfy me. I won’t be taking feedback at this time on what this particular refusal to be satisfied with something obviously moving in the right direction means for my future as a parent, thank you – all that’s important is that I decided I wanted to see the trend for Florence’s exact starting centile.

I originally assumed there’d be a online tool to immediately produce exactly this a quick google away but it turns out not. There’s plenty of calculators that will tell you your baby’s centile based on a given weight but nothing that I could find to plot the expected trend for that centile.

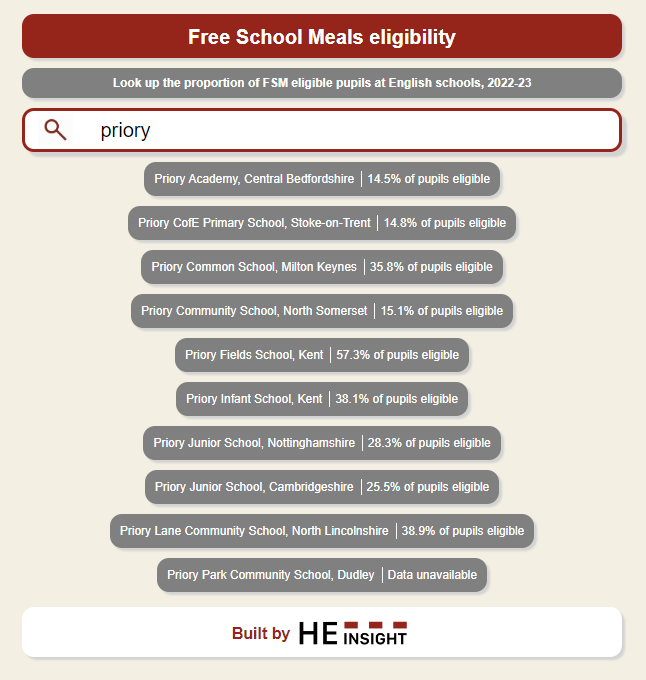

(Interestingly, during my searches I found this tool from the University of Leicester which places Florence at a slightly higher – though still well under 1st – centile than I went on to calculate as it’s based on a different dataset which is much more recent than the WHO data and England & Wales specific).

I realised I’d need to go to the source and get the data to calculate the trend myself. After a lot of searching I eventually found this cracker of a 262-page PDF write up from the WHO. I lost some time to getting my head around the values in this document’s tables being velocities rather than weights and figured out the importance of smoothed centile curves in the process of understanding why some of these velocity values were negative. Still, the important thing was that this document provided the underlying Lambda-Mu-Sigma values needed to calculate the LMS curve for any given centile.

I didn’t fancy having to extract these values from a PDF though (and fancied even less asking an LLM to do it for me and potentially hallucinate half the values), so after even more searching I stumbled across the The Royal College of Paediatrics and Child Health’s growth-references git repository here.

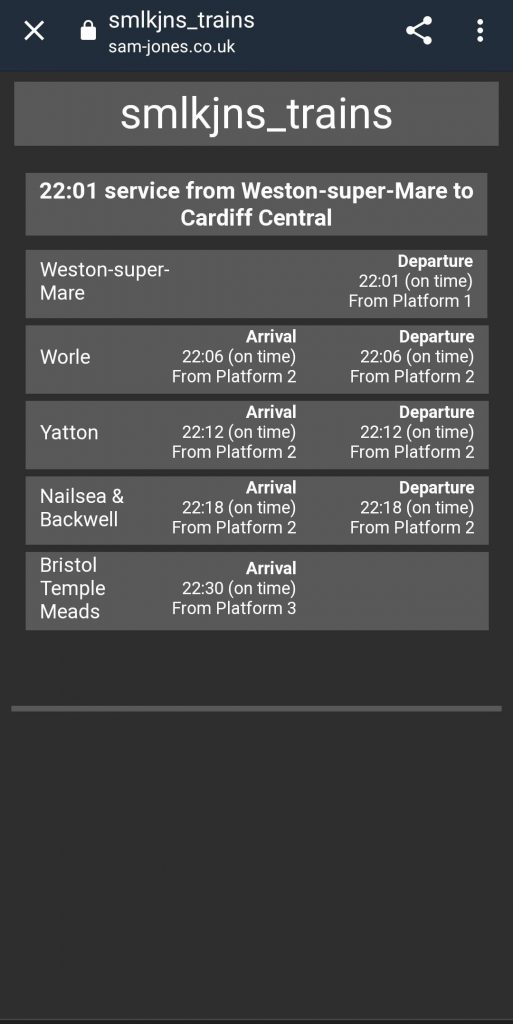

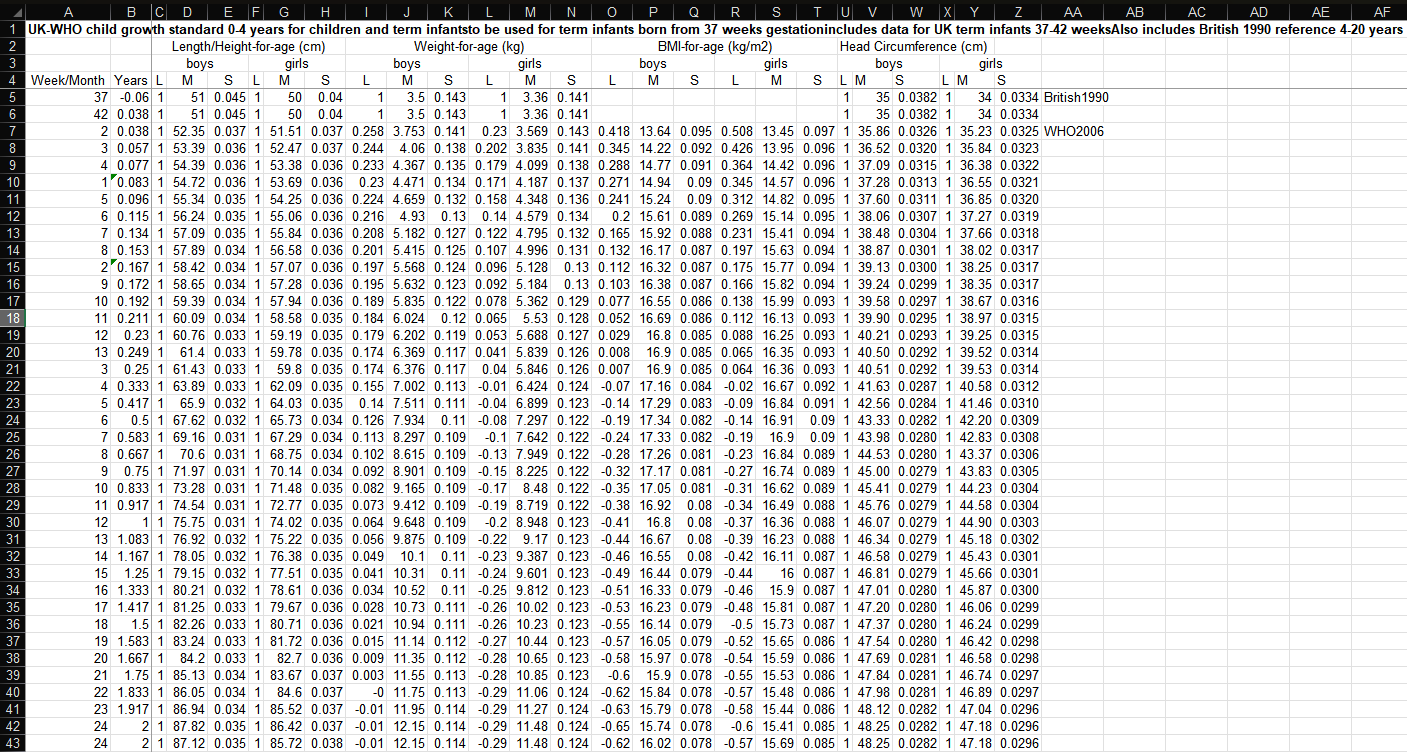

Florence was born at 37+1, so was 2 days clear of the threshold to be considered at term and so I referred to the term rather than preterm data in this repo. Here’s that table in all it’s glory:

There are those L, M, S values that I needed to construct the smoothed curve. Setting aside the slightly confusing mixed economy of weeks/months in the first column, you can see that the pre-birth rows (37 and 42 weeks gestation, the bounds of a baby considered born at term) belong to a different dataset than the post-birth rows. That latter dataset only starts at 2 weeks, so that’s actually the point I used to baseline Florence rather than her birth weight. I’ve no idea if this is the correct approach but I also happened to have a weight reading for Florence at exactly 2 weeks, so it was at least the convenient approach.

There are those L, M, S values that I needed to construct the smoothed curve. Setting aside the slightly confusing mixed economy of weeks/months in the first column, you can see that the pre-birth rows (37 and 42 weeks gestation, the bounds of a baby considered born at term) belong to a different dataset than the post-birth rows. That latter dataset only starts at 2 weeks, so that’s actually the point I used to baseline Florence rather than her birth weight. I’ve no idea if this is the correct approach but I also happened to have a weight reading for Florence at exactly 2 weeks, so it was at least the convenient approach.

Now for the little matter of turning those LMS values into a smoothed curve. It would be fair to say this is not my area of expertise… I considered trying to get this Excel add-in recommended by the RCPCH working but I’ve previously been burnt by attempting to use 90s-ass Excel add-ins in my work life and having thought about it decided I’d rather throw sand in my eyes than go down that path again. Instead, I figured out how to calculate the curves for a given percentile myself by opening somewhere between 20 and 30 different browser tabs on my phone and somehow compiling a half-understanding of what I needed to do in the middle of the night whilst in a state of deliriousness as Florence had one of her customary blood curdling screams directly into my left eardrum.

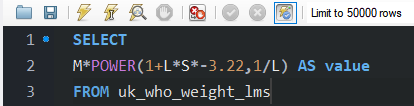

I worked out the z-score for Florence based on that 2-week baseline to be -3.22 (3.22 standard deviations below mean) which means she was on the 0.07th percentile, or in other words 99.93% of babies were bigger than her in the UK-WHO dataset.

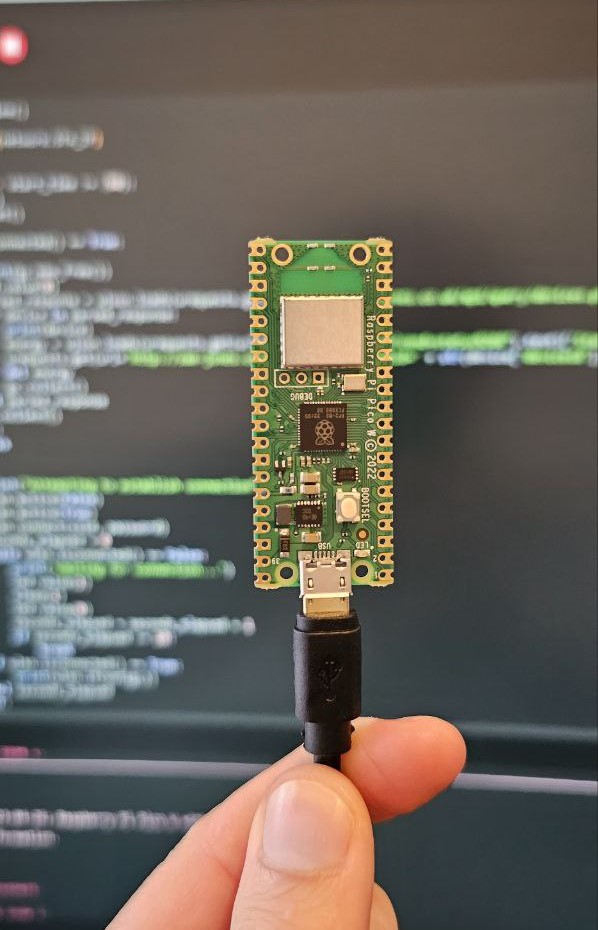

Because I refuse to ever do maths properly and insist on being half-idiot, I think better in SQL. With the data imported into a table and some cleaning up of those intermixed week/month values, here’s the code to calculate the curve plot for Florence’s starting centile.

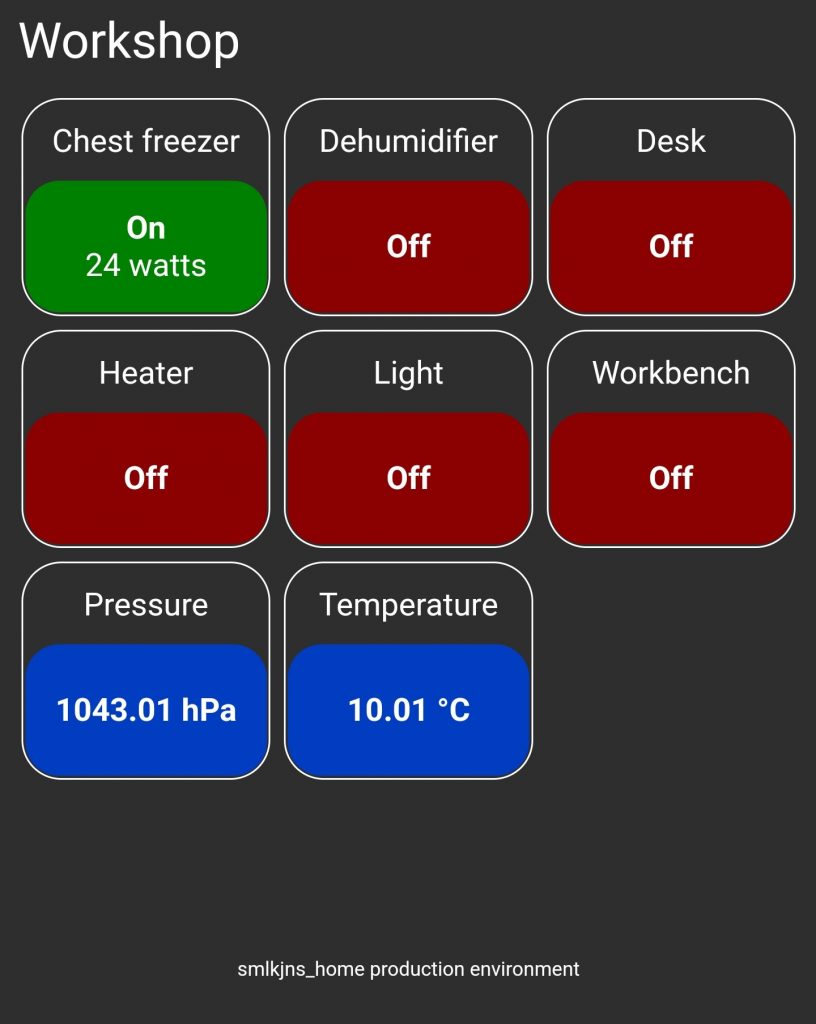

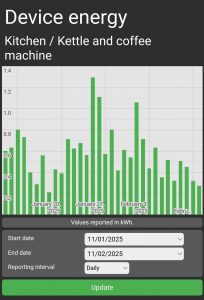

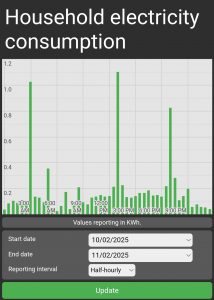

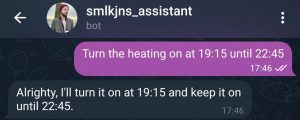

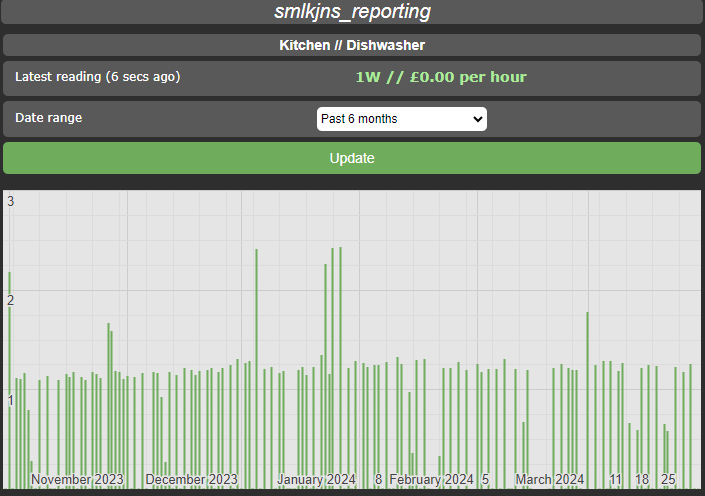

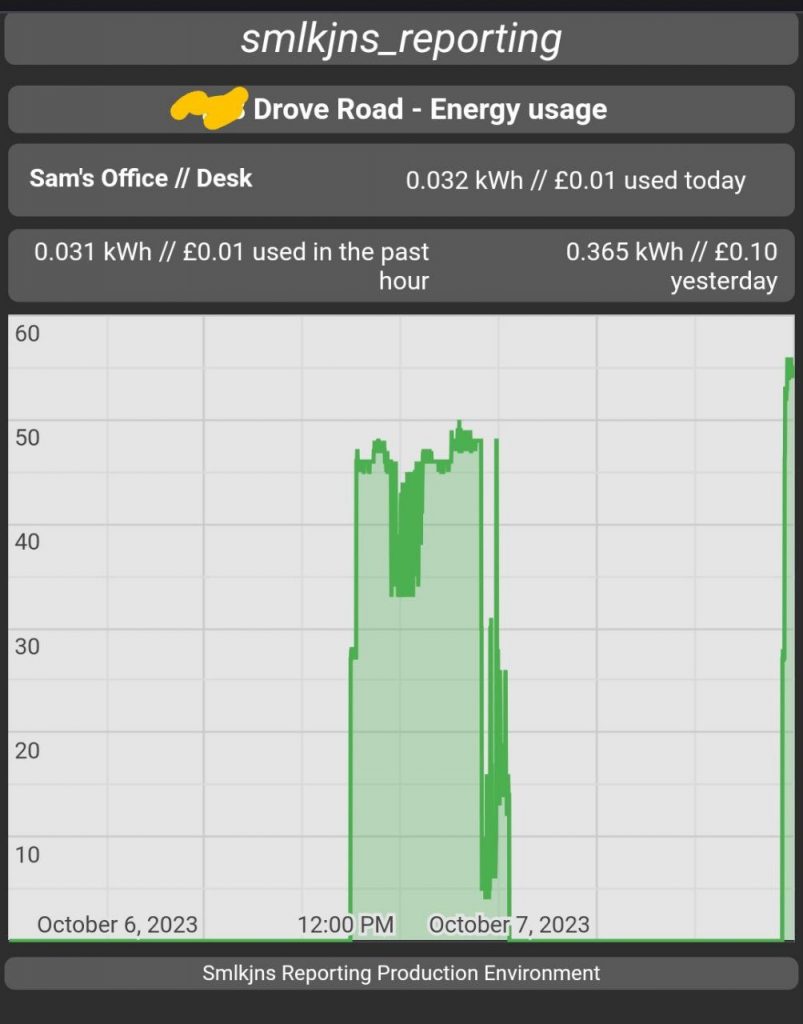

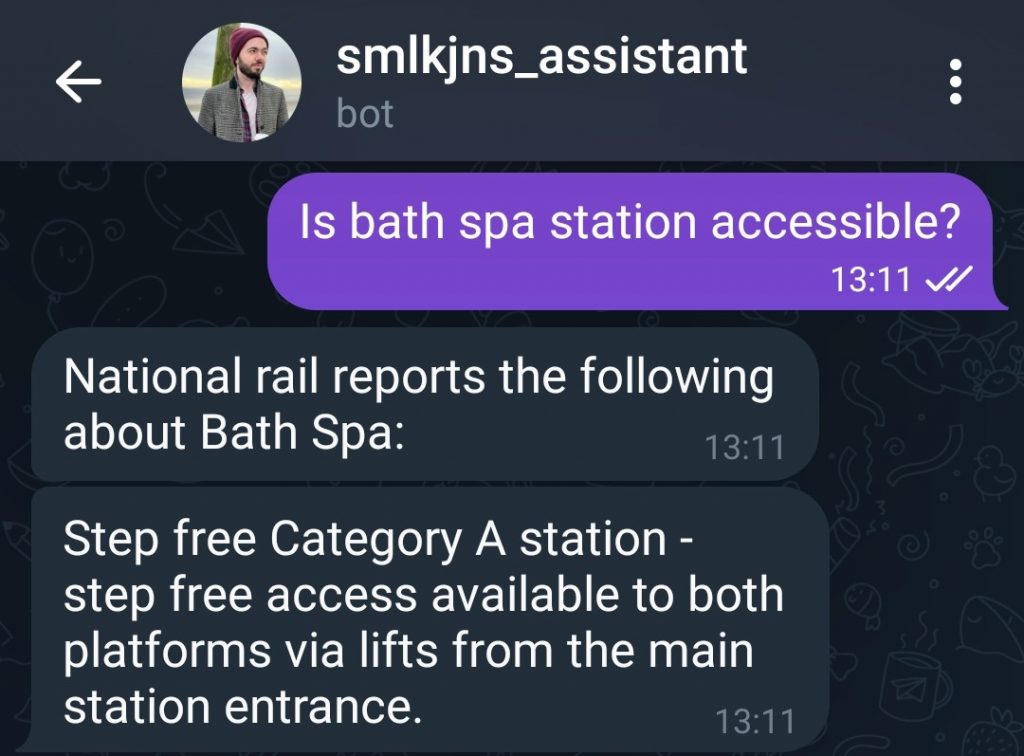

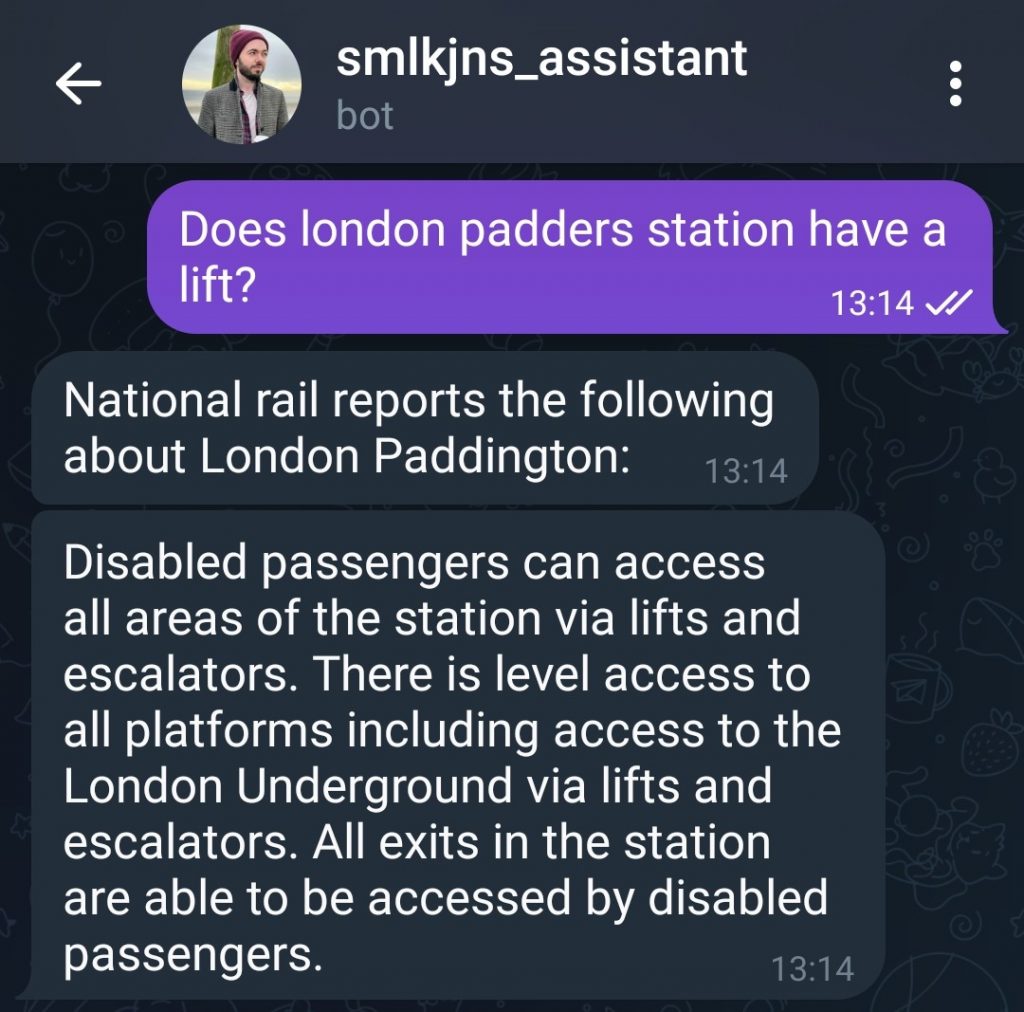

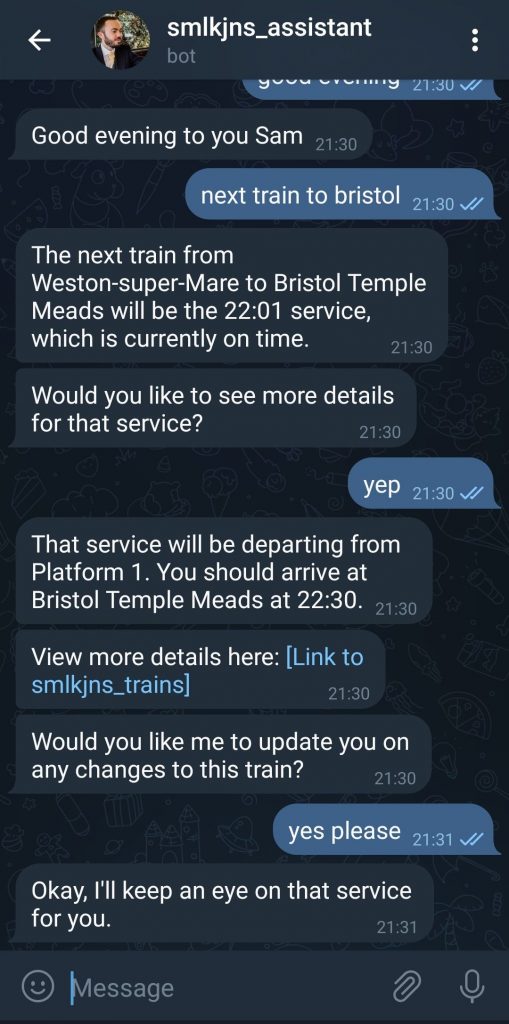

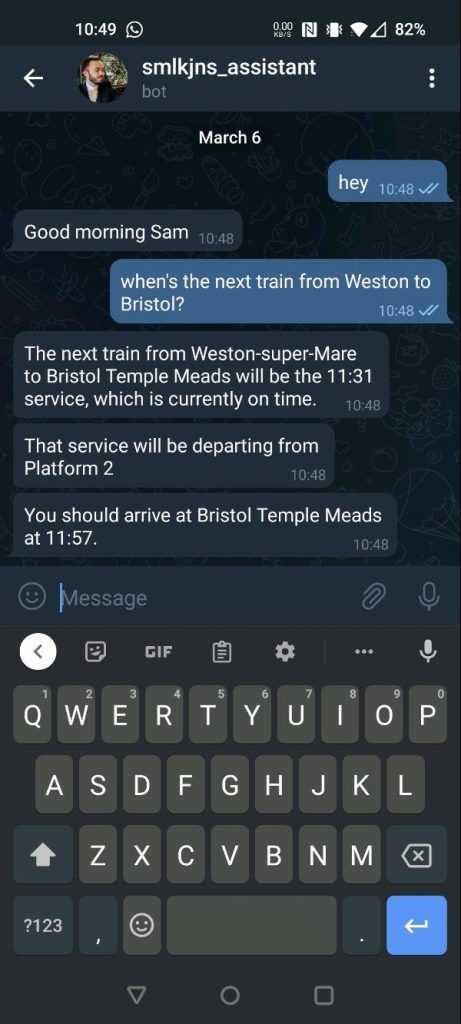

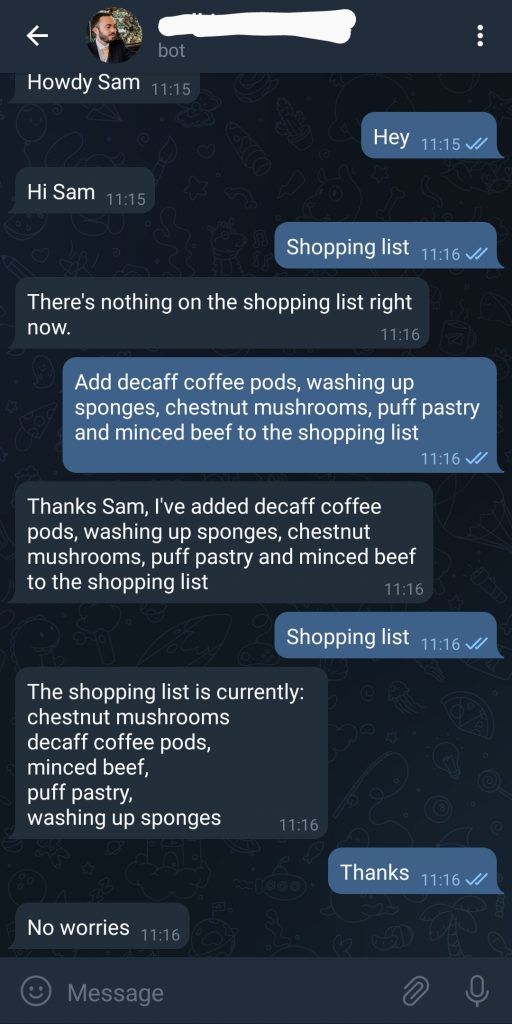

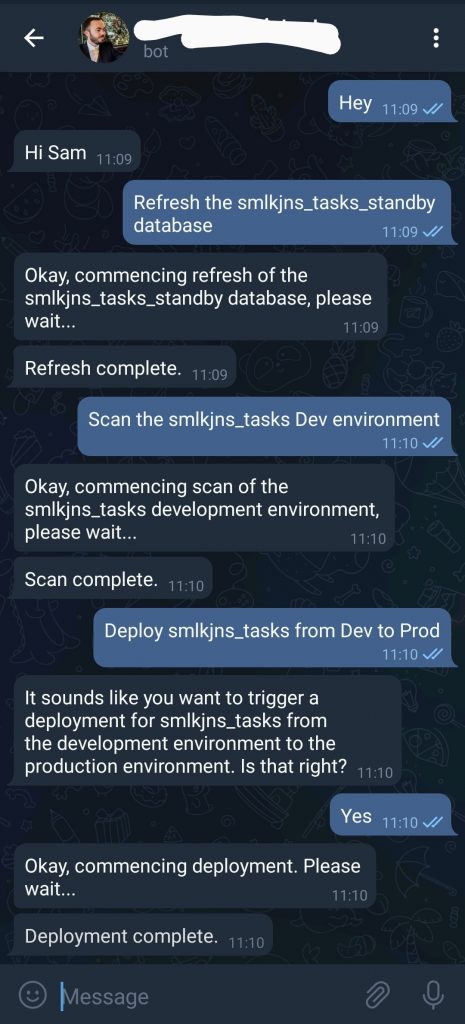

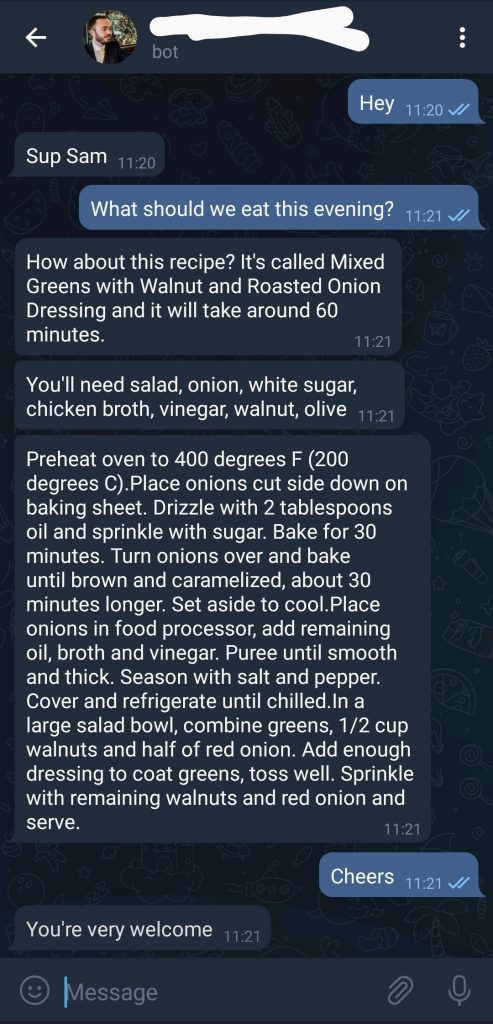

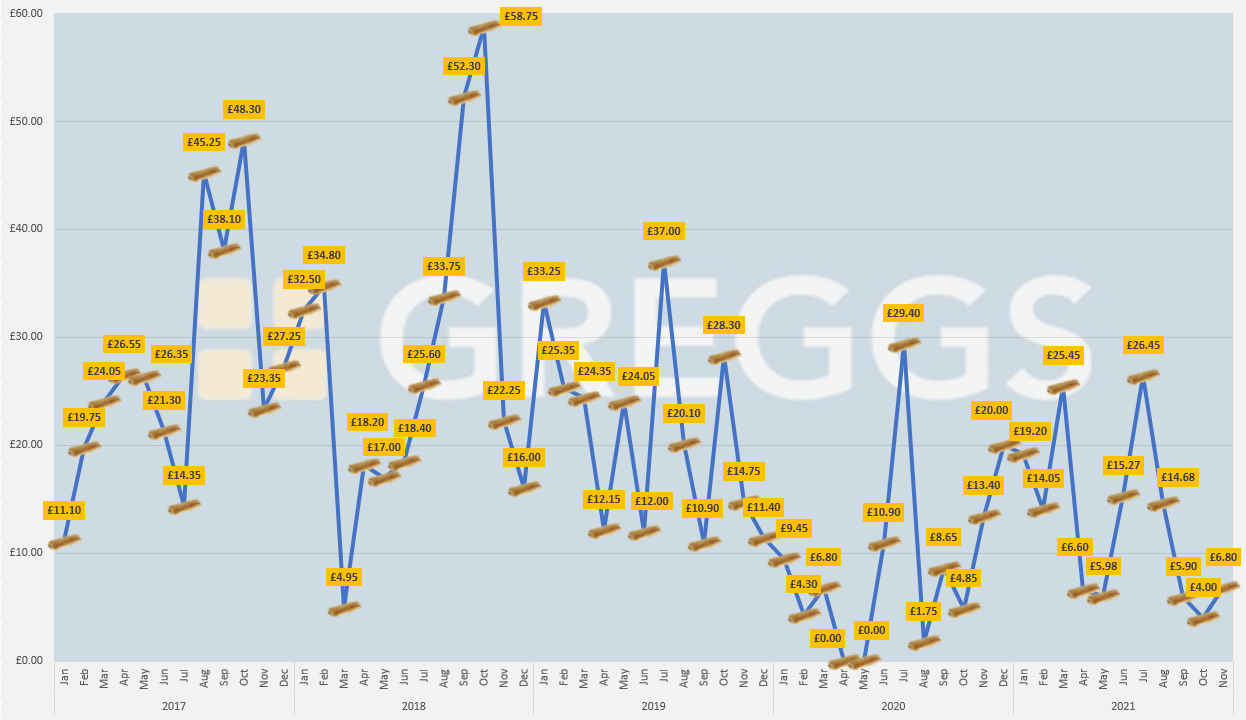

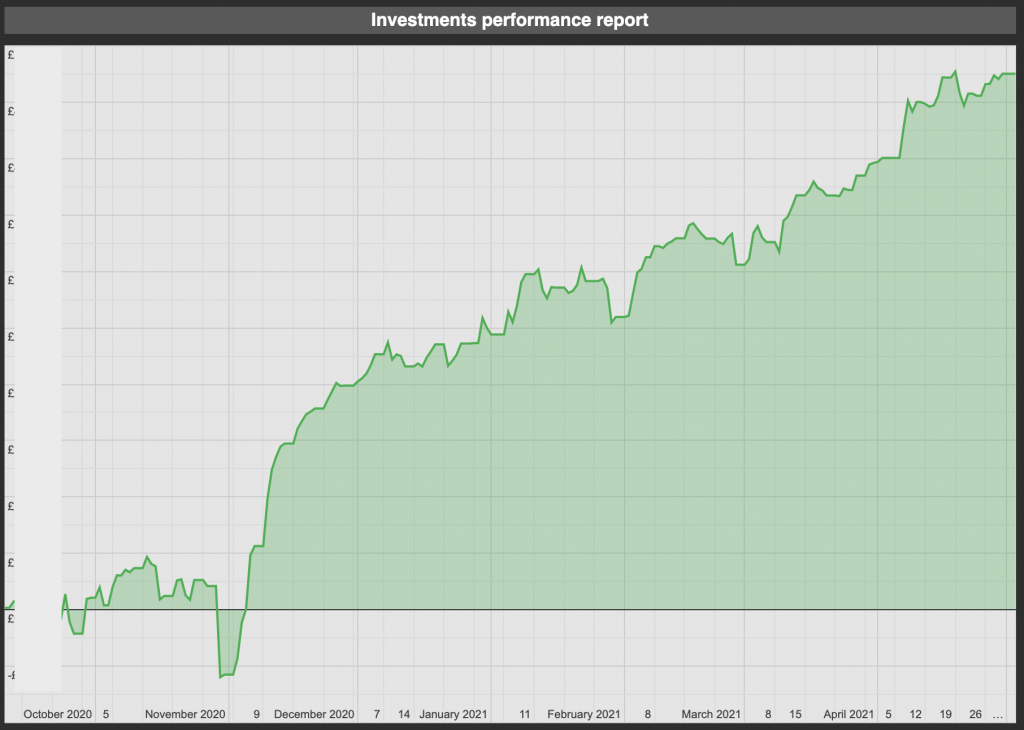

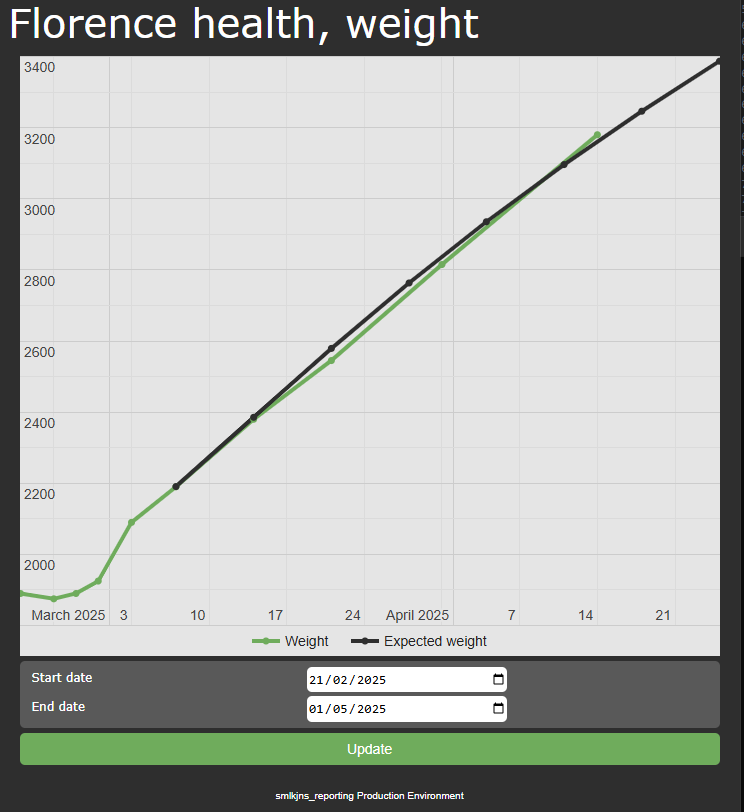

With Florence’s weigh-ins stored by smlkjns_assistant, I can finally plot her weight trend against the expected trend specific to her. Here it is:

Would you look at that – turns out she’s following her expected trend almost perfectly.

Aside from making me feel much happier that she is actually gaining enough weight, calculating her expected trend also allows us to predict when she’ll reach a given weight, something that’s very useful to us given the number of Florence-accessories we have in various forms that she was born a long way below the minimum recommended weight for.

Anyway, Florence is doing great and I’ve made a new chart, two things that make me happy.

I’ve consciously given an account of Florence’s birth here that doesn’t really touch on Soph’s experience. Suffice to say Soph responded to a seemingly never-ending cascade of impossibly horrible things she had to suffer through with unfathomable strength and I am in awe of what she did to bring Florence into the world for us. You might also like to read her somewhat more cheerful write up of a recent day with Florence here.

Thanks also in particular to Soph’s mum Teresa who flew over to us twice on short notice, was a consistently incredible support and put up with me for the probably 15 hours we spent in the car together as I drove us the same route to the hospital and back over and over again even as I went slowly mad.

Finally thanks to our many wonderful friends who have been with us through moments both fantastic and awful. We owe so much to you all.